Lear Corporation

Summary

Covers Lear Corporation exhibition participation, products, technologies, and major customers. Offers exclusive information available only on MarkLines to support research and analysis in the automotive industry.

Company Profile

Business Overview

-The Company supplies complete seat systems, seating components, electrical distribution and connection systems, power distribution products, battery disconnect units, electronic controllers, and other electronic modules as well as related sub-systems, components and software, to all of the world's major automotive manufacturers.

-Its business is organized under two reporting segments: Seating and E-Systems. Each of these segments has a varied product and technology range across a number of component categories:

- Seating

- Design, development, engineering, just-in-time assembly and delivery of complete seat systems

- Design, development, engineering and manufacture of all major seat components, including seat covers and surface materials such as leather and fabric, seat structures and mechanisms, seat foam and headrests

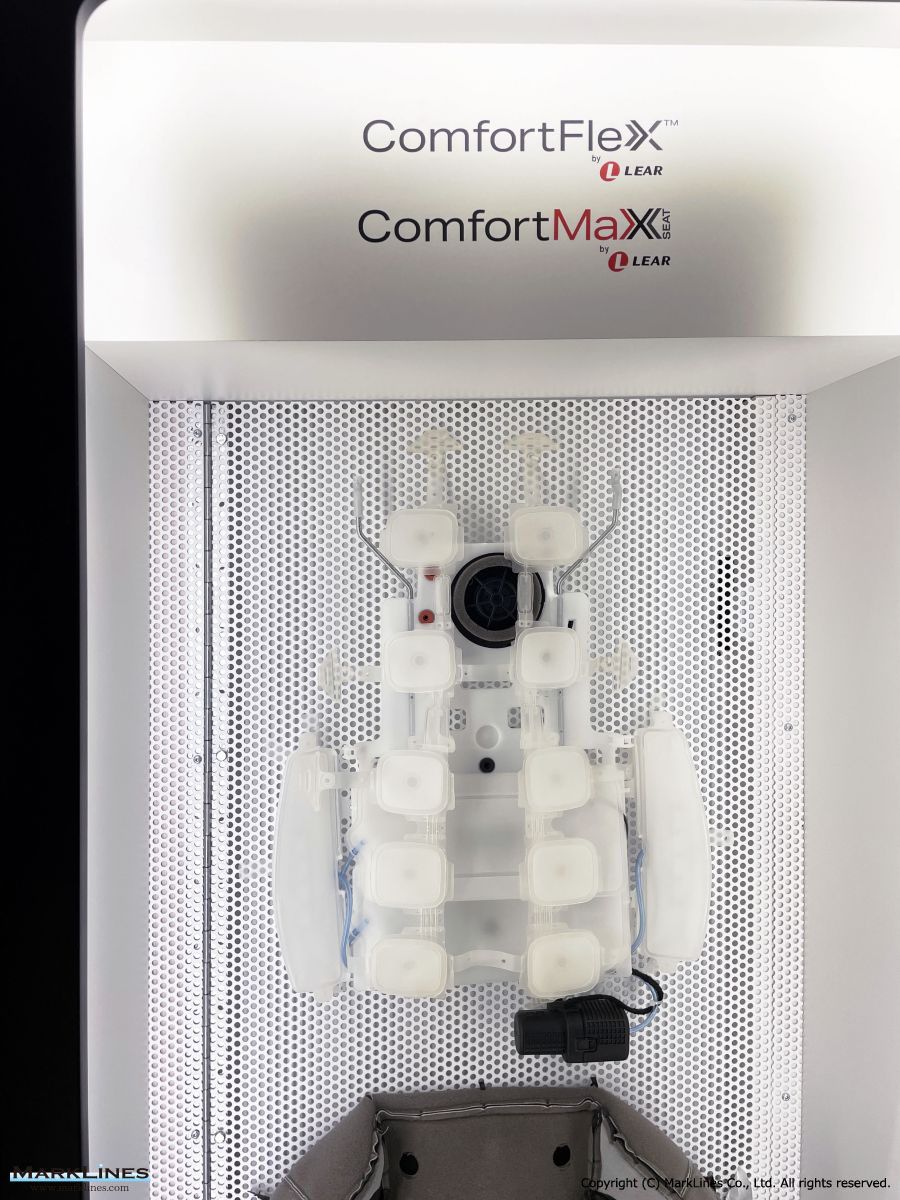

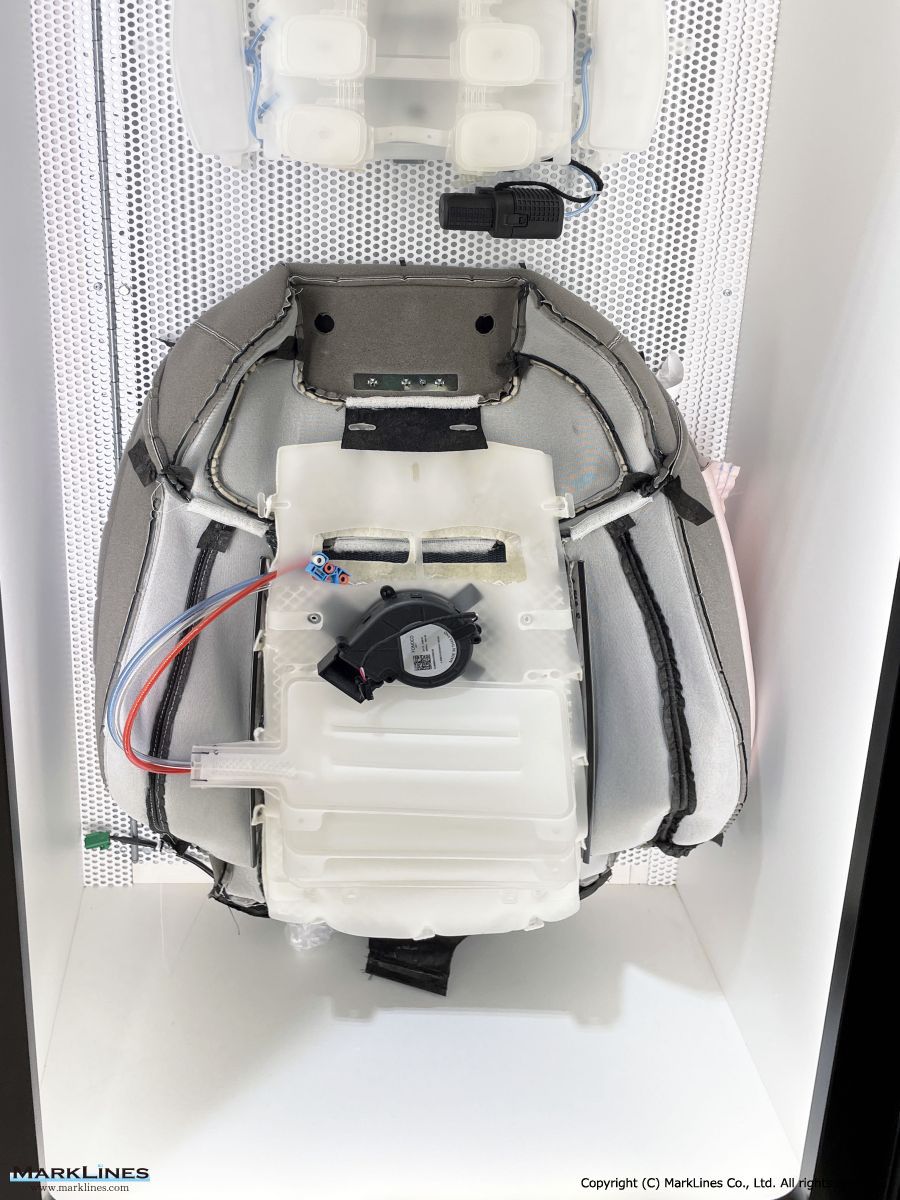

- Active sensing, safety, connectivity, user experience and comfort for seats, utilizing electronically controlled systems and internally developed algorithms

- E-Systems

- Design, development, engineering and manufacture of complete electrical distribution systems

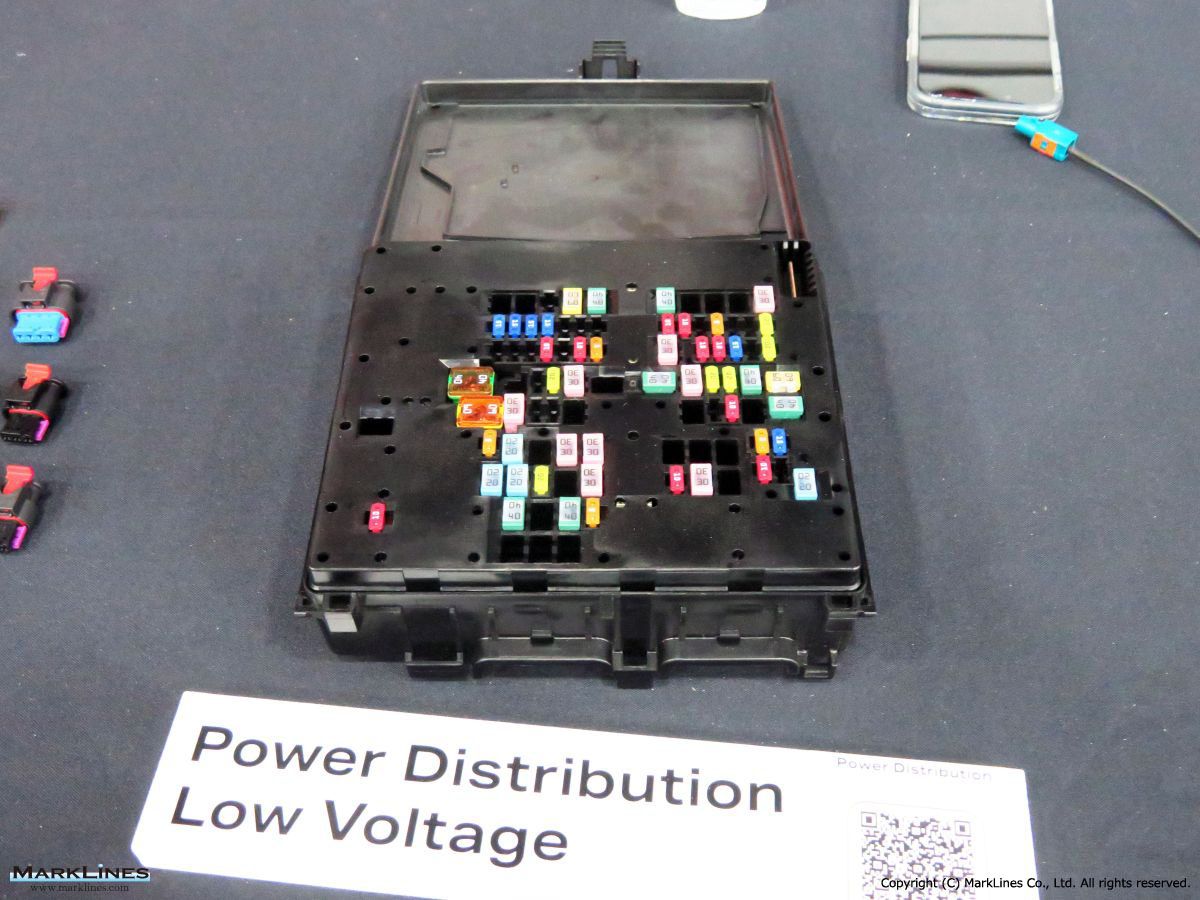

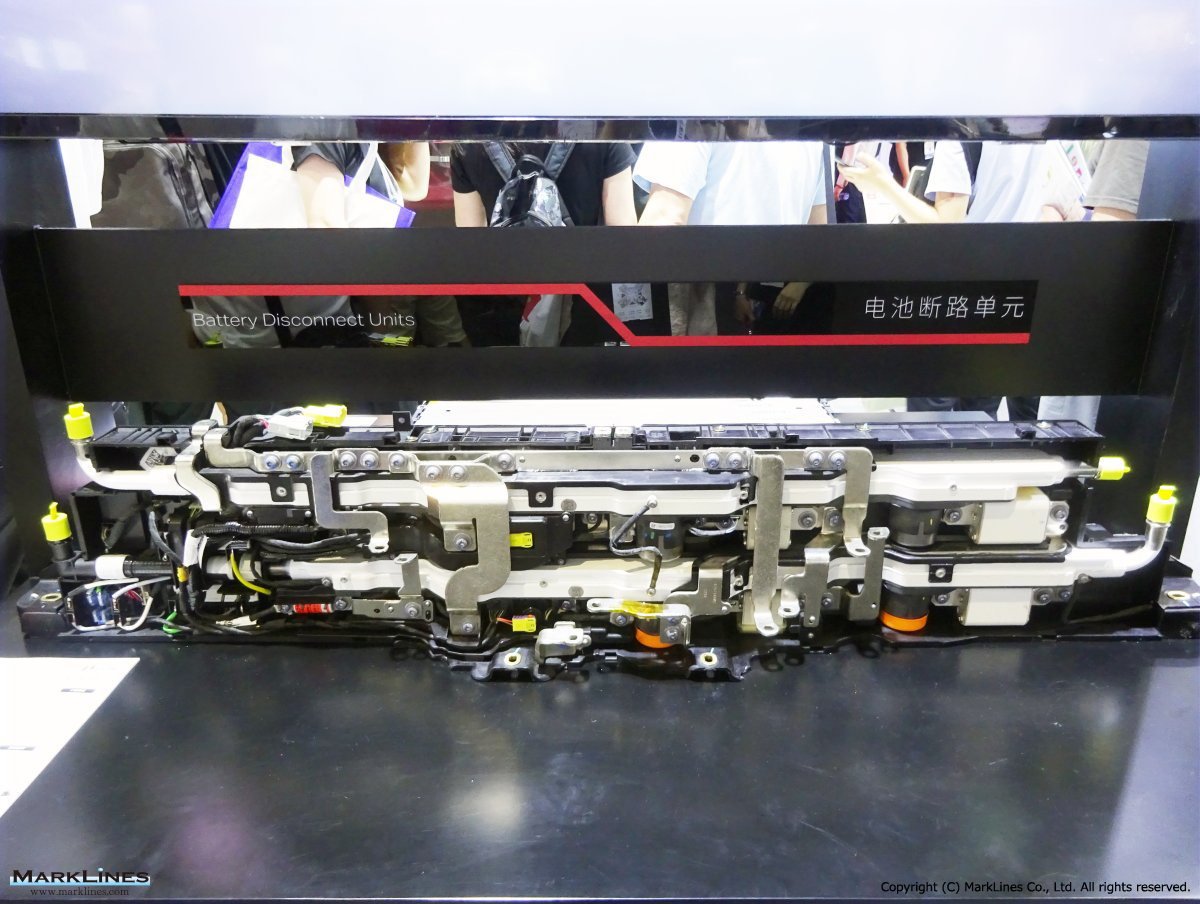

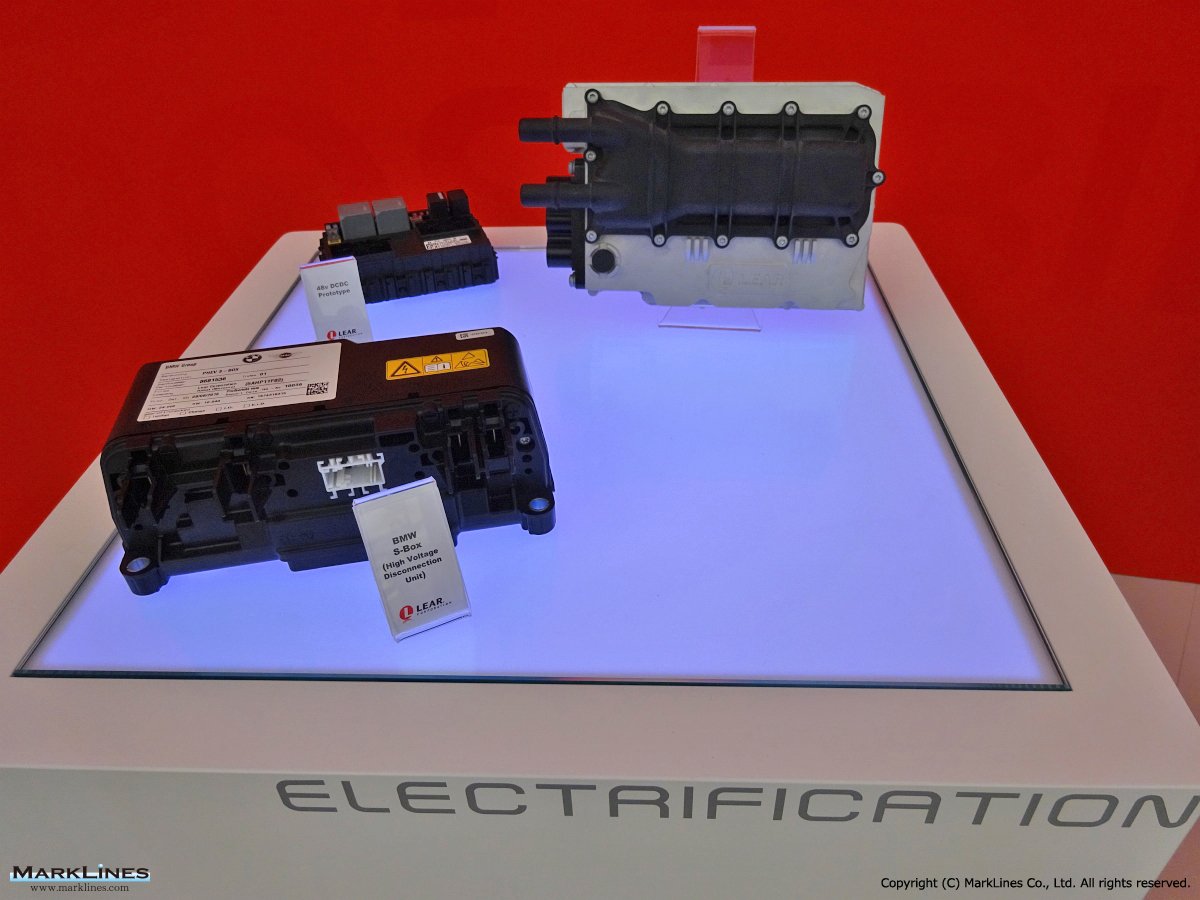

- Design, development, engineering and manufacture of power distribution systems and battery disconnect units

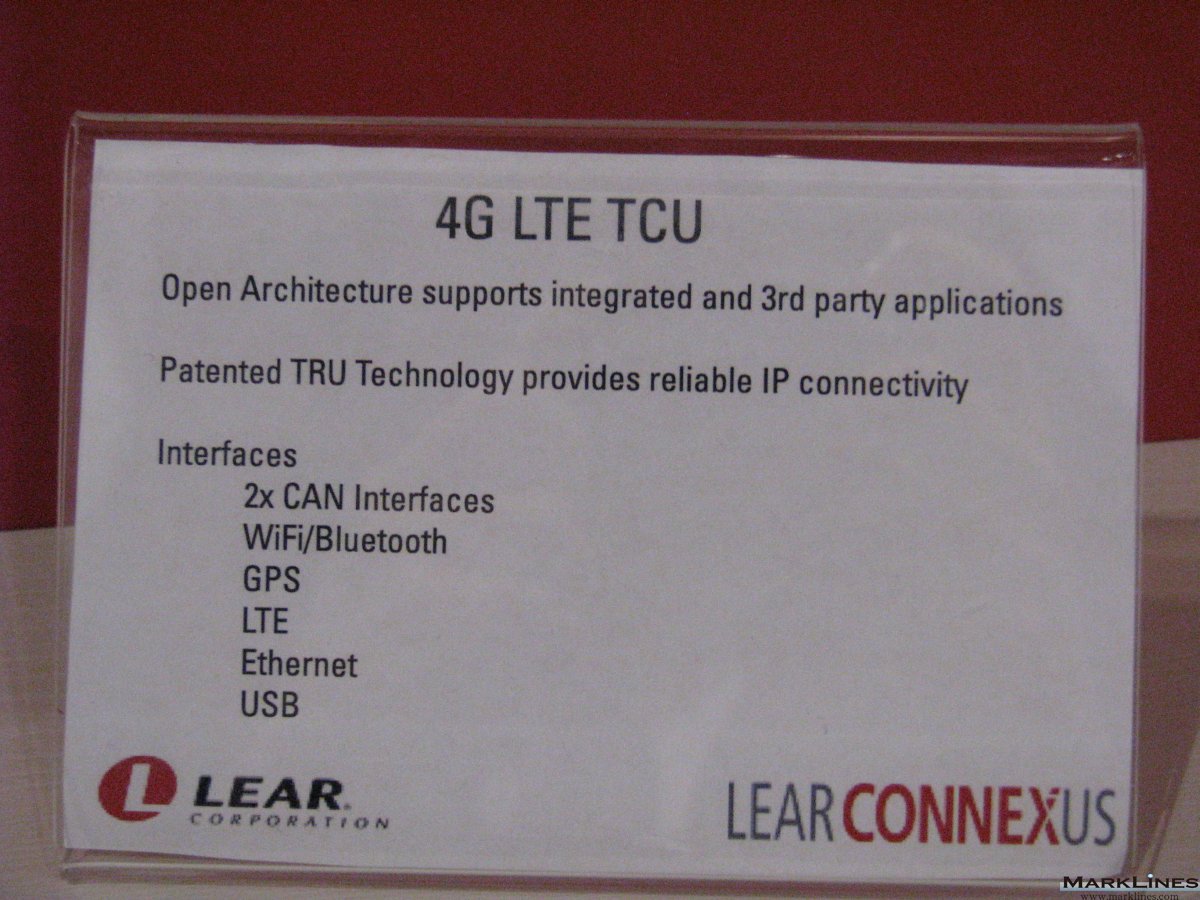

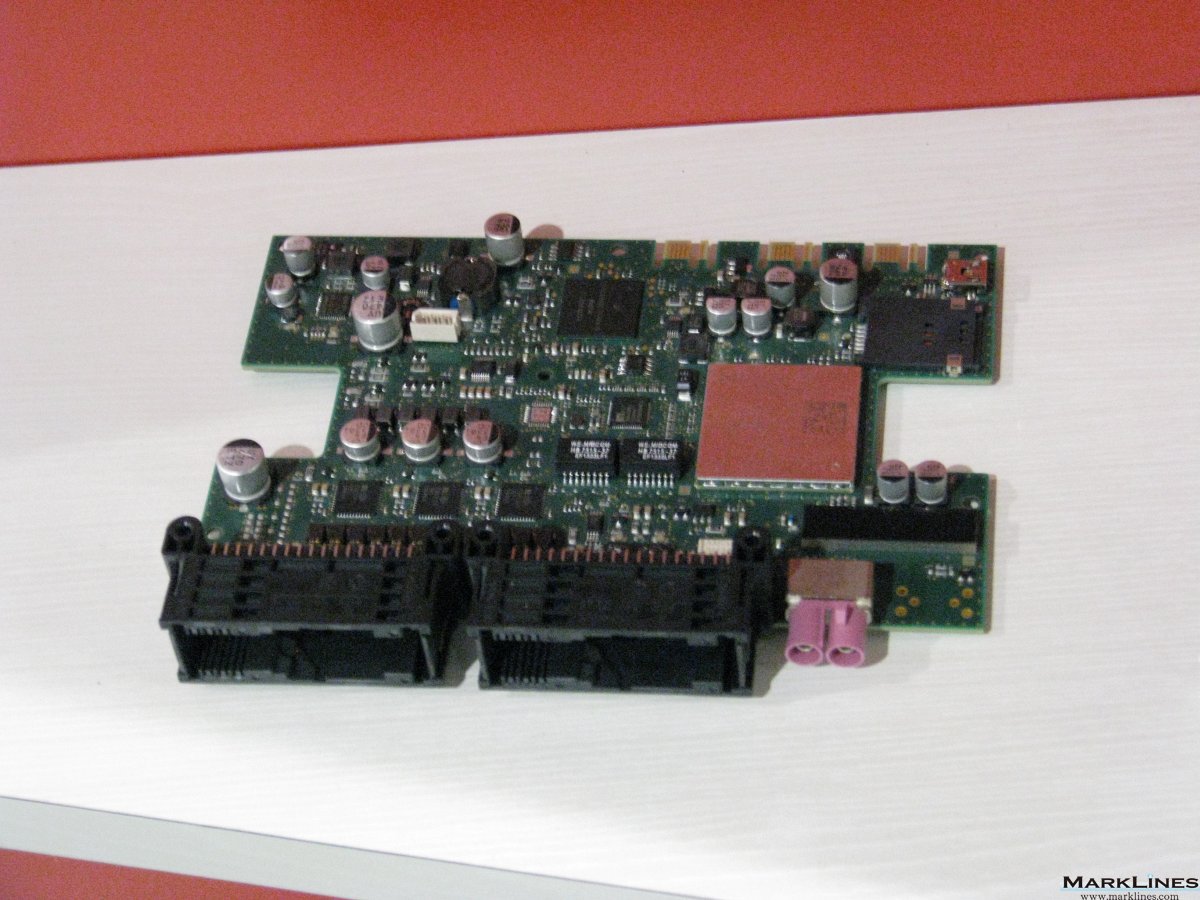

- Sophisticated electronic control modules, electrification products and connectivity products

Competitors

| Seating Segment | E-Systems Segment |

| -Adient -Forvia -Magna International -Toyota Boshoku -TS Tech -Yanfeng |

-Aptiv -Bosch -CATL -Continental -Delta Electronics -Denso -Harman -Hella -Leoni -LG Energy Systems -Molex -Panasonic -Sumitomo Electric Industries -TE Connectivity -Valeo -Visteon -Yazaki |

-Based on independent market studies and estimates, the Company is one of the two largest suppliers of complete seat systems globally with a 26% global market share on the basis of revenue for the fiscal year ended December 31, 2024. The Company has a mid-term target of achieving a global market share of 29% in complete automotive seat systems.

-In April 2023, the Company completed the acquisition of I.G. Bauerhin (IGB), a private supplier of automotive seat heating, ventiliation, cooling, sensors, steering wheel heating and ECUs, for EUR 175 million. IGB's products enhance the Company’s Thermal Comfort Systems portfolio, which combines efficient heating, ventilation and active cooling, lumbar support and massage with its seating craftsmanship.

Shareholders

-The Company is listed on the New York Stock Exchange.

Products

Seating

-Complete seat systems

-Seat covers

-Seat structures

-Seating mechanisms (recliners, tracks, latches)

-Foam technologies

-Seating comfort systems including massage, lumbar support, thermal comfort, and ventilation

-Seating electronic control modules

-INTU intelligent seating systems with advanced comfort solutions

-Eagle Ottawa Leather

-Guilford Performance Textiles

-ConfigurE+ configurable seating architecture system

-Ansole leather finishing technology

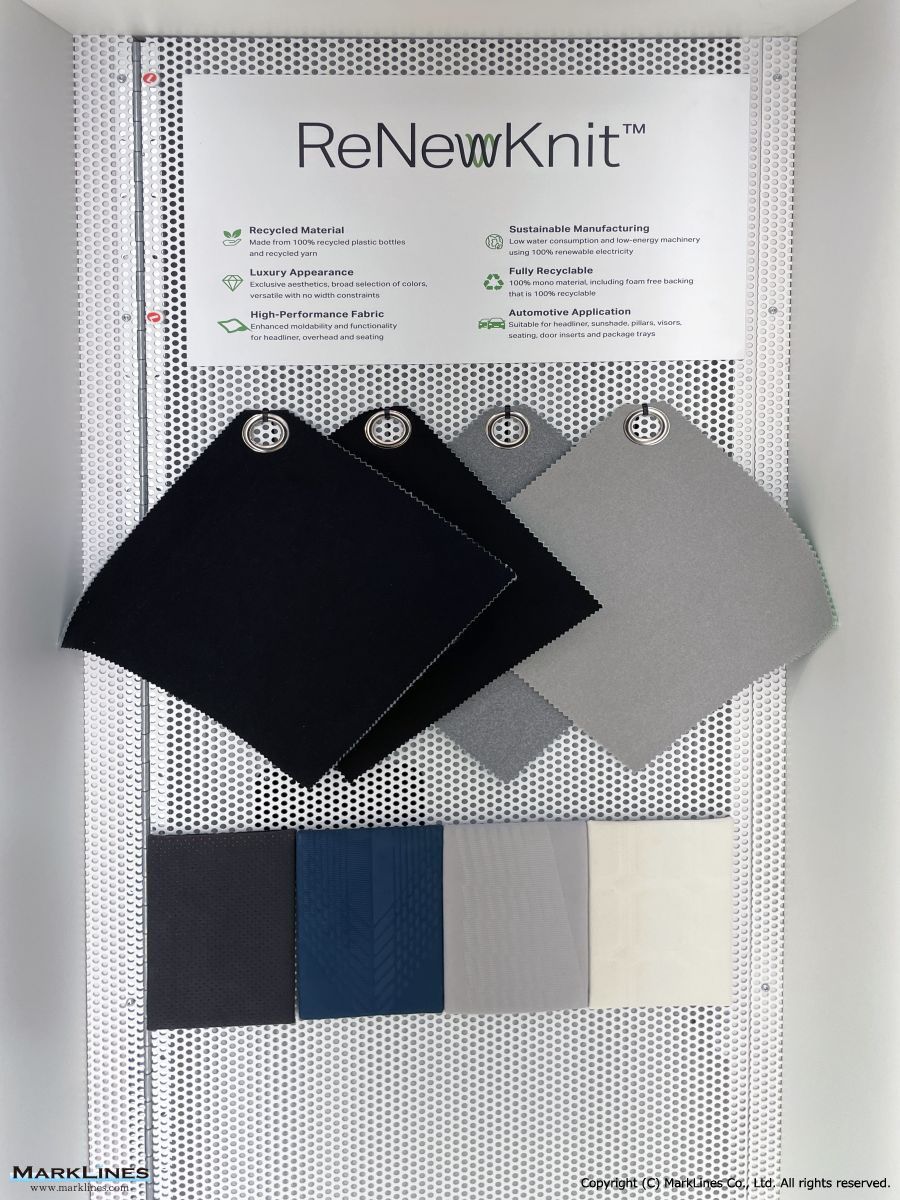

-ReNewKnit sustainable sueded alternative material

-TeXstyle surface material coatings

-SoyFoam low-profile, low-emissions foam

-FlexAir recyclable non-foam alternative

-Zero gravity seats

E-Systems

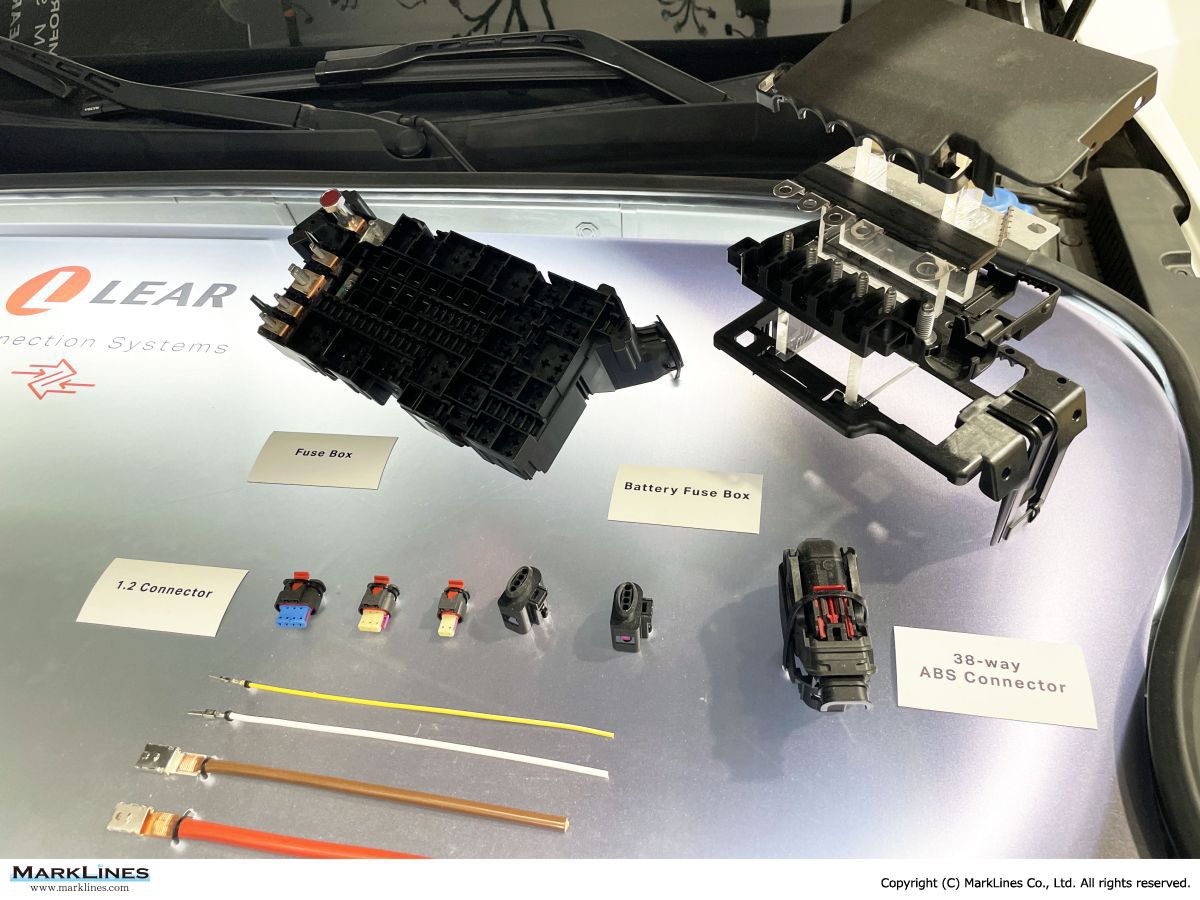

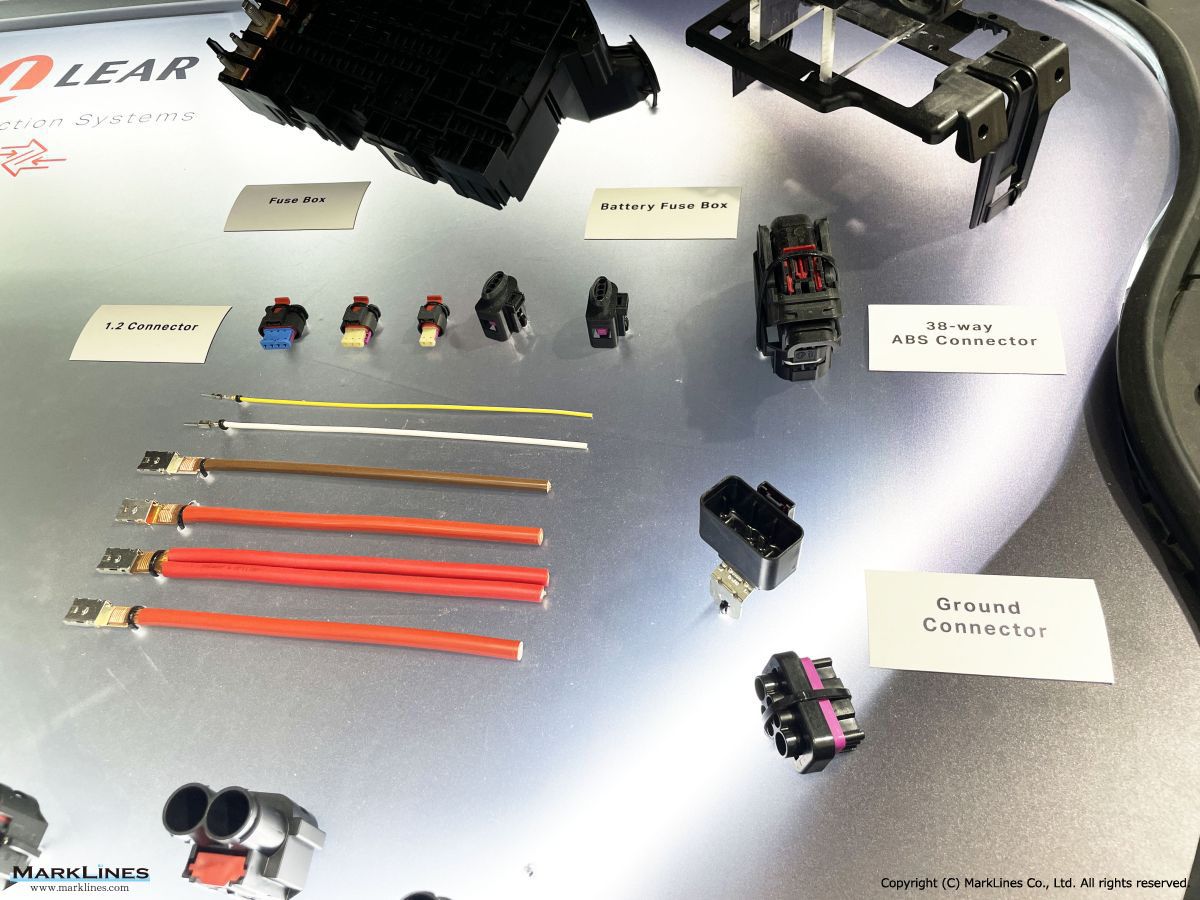

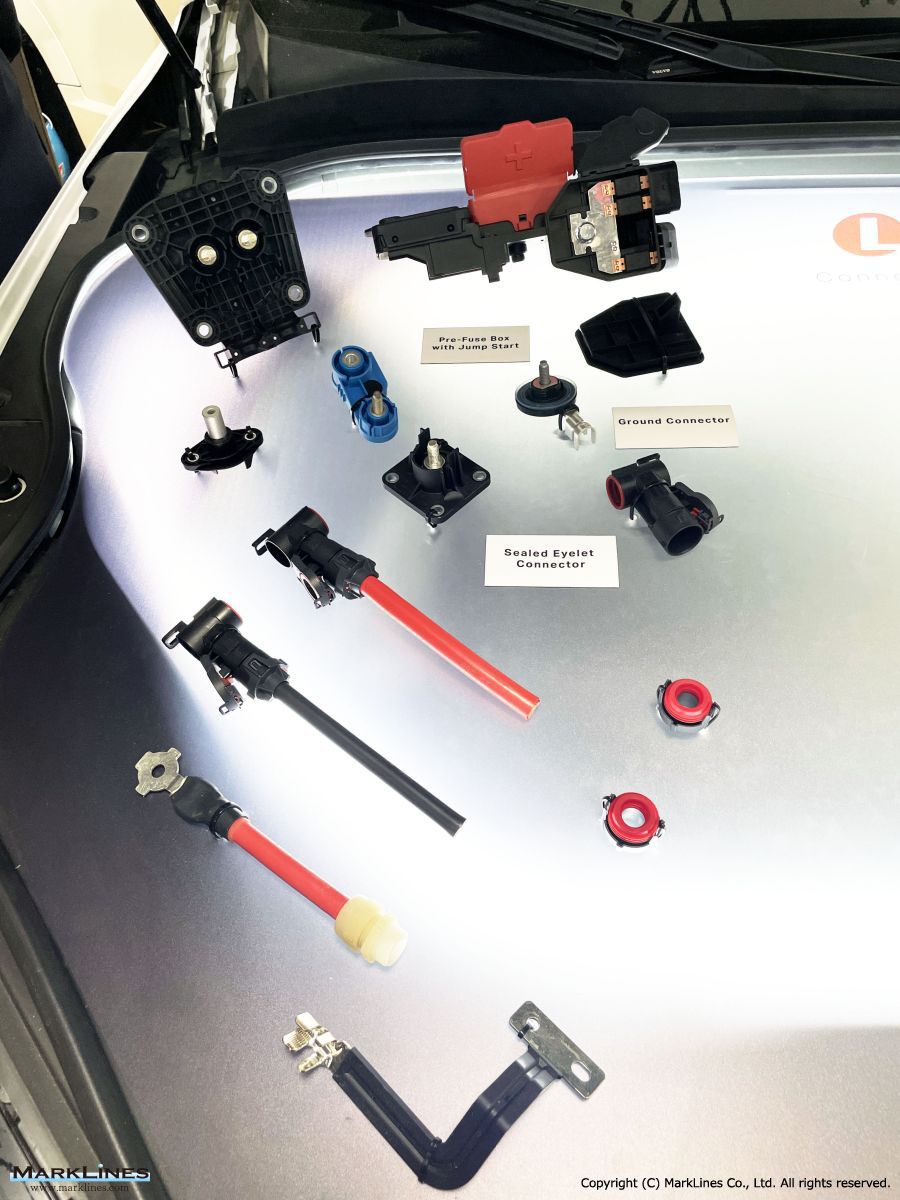

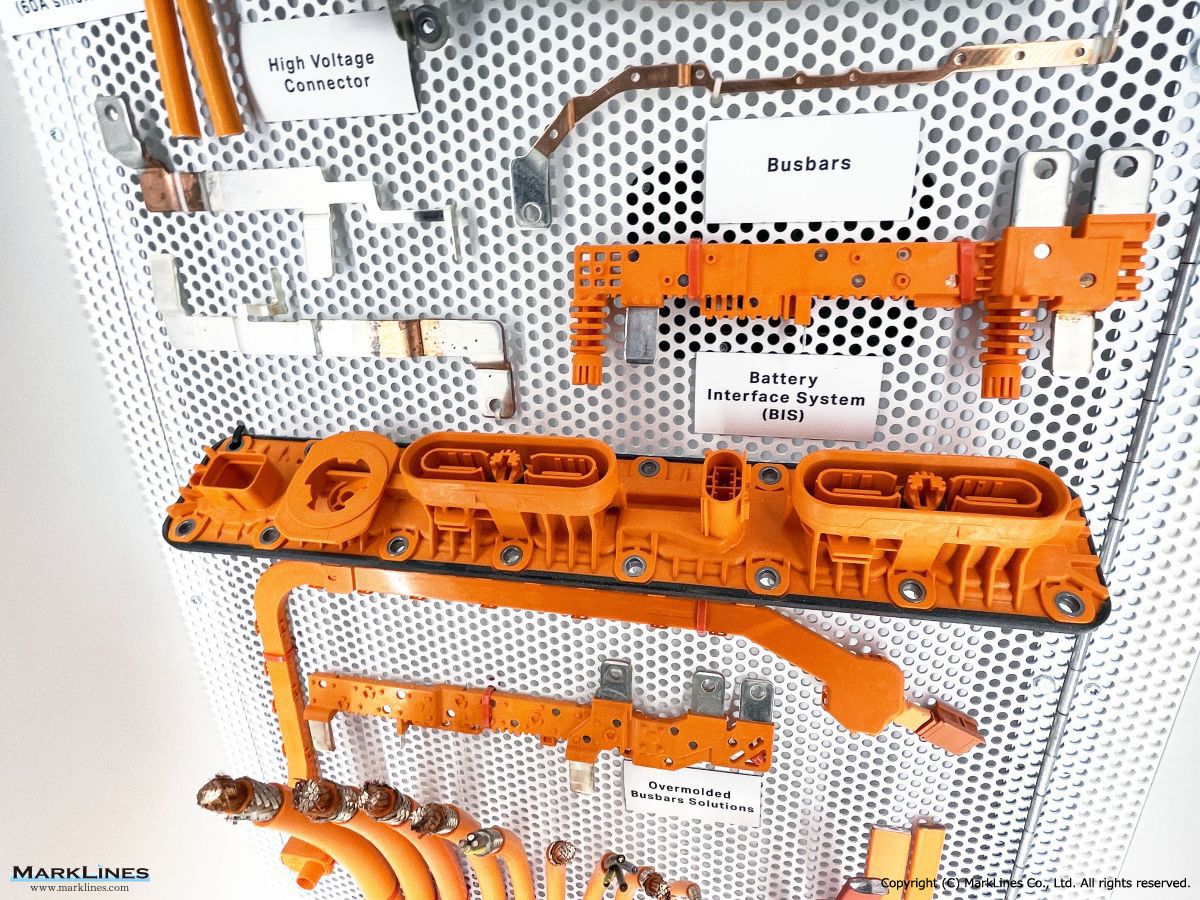

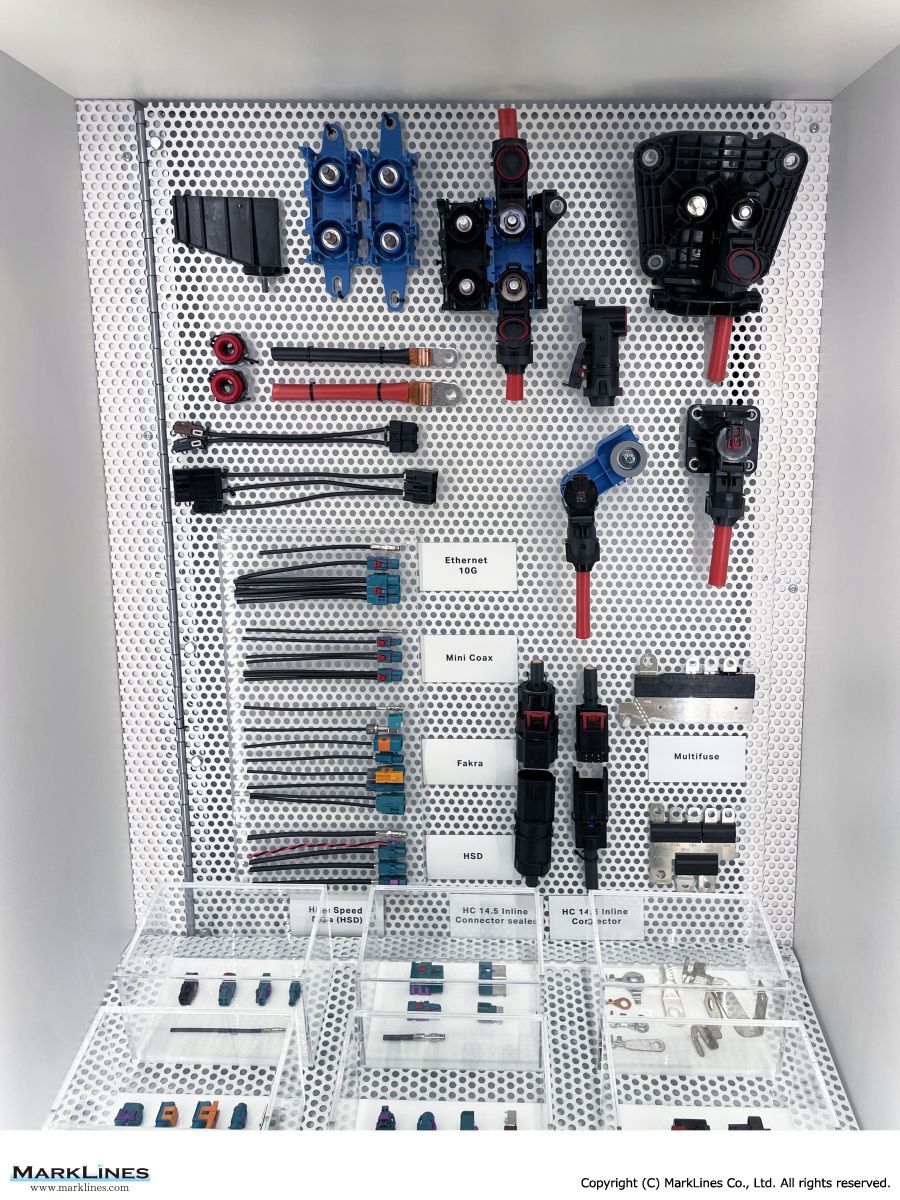

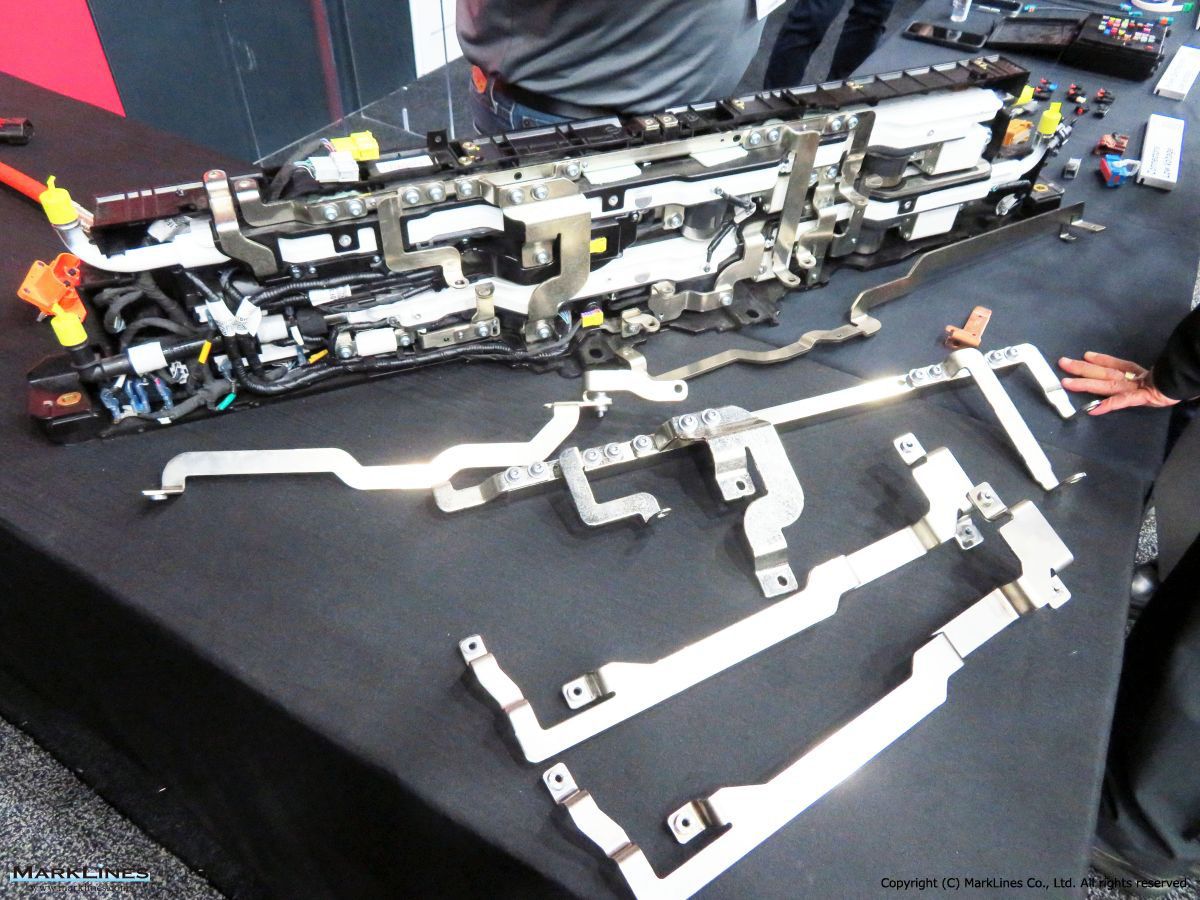

-Wire harnesses

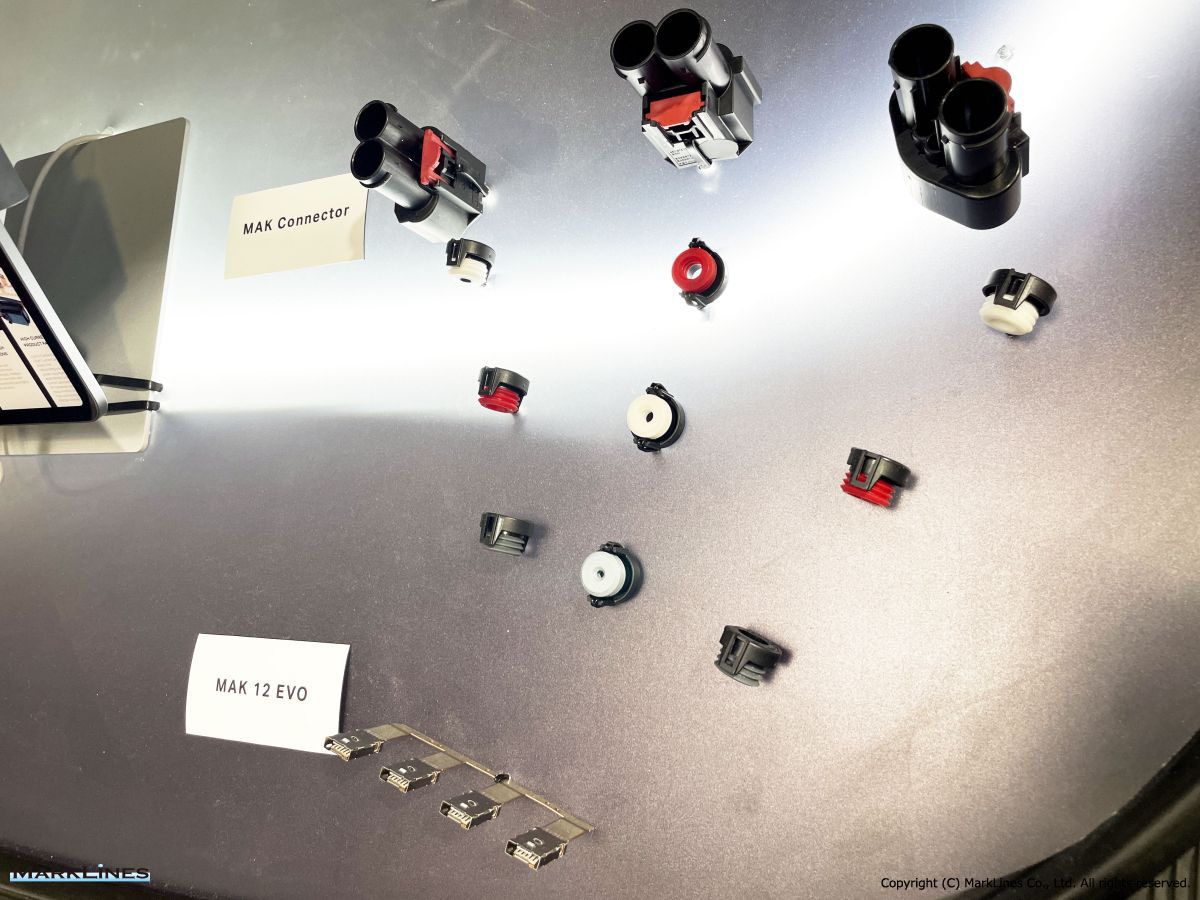

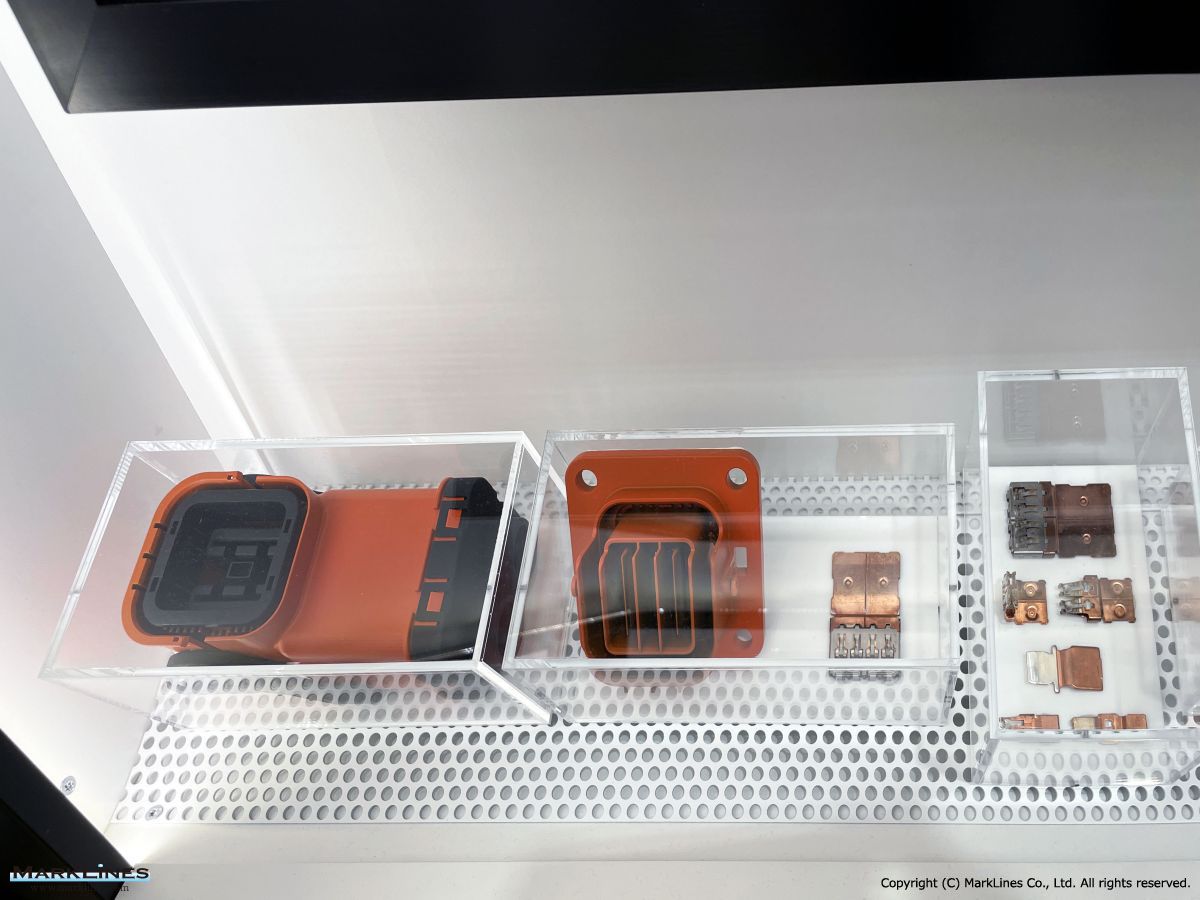

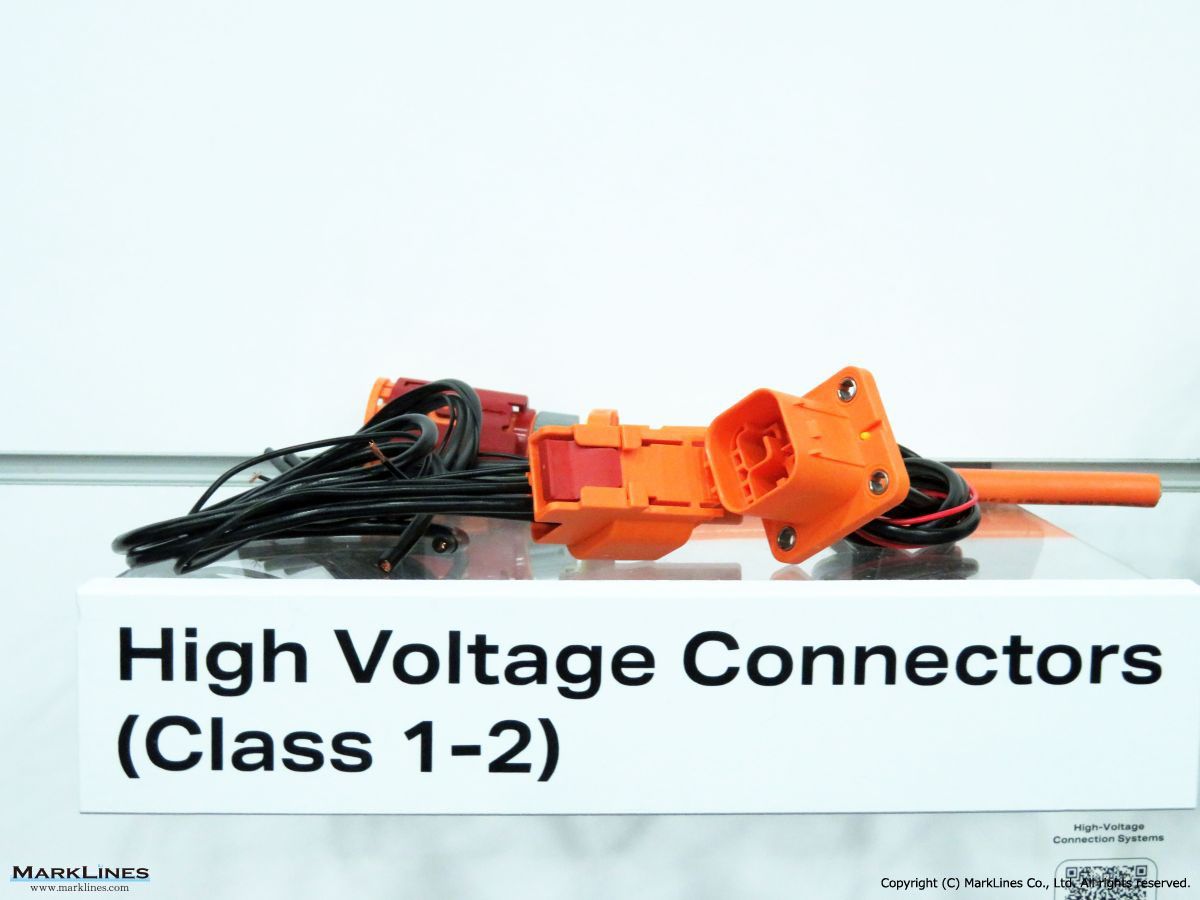

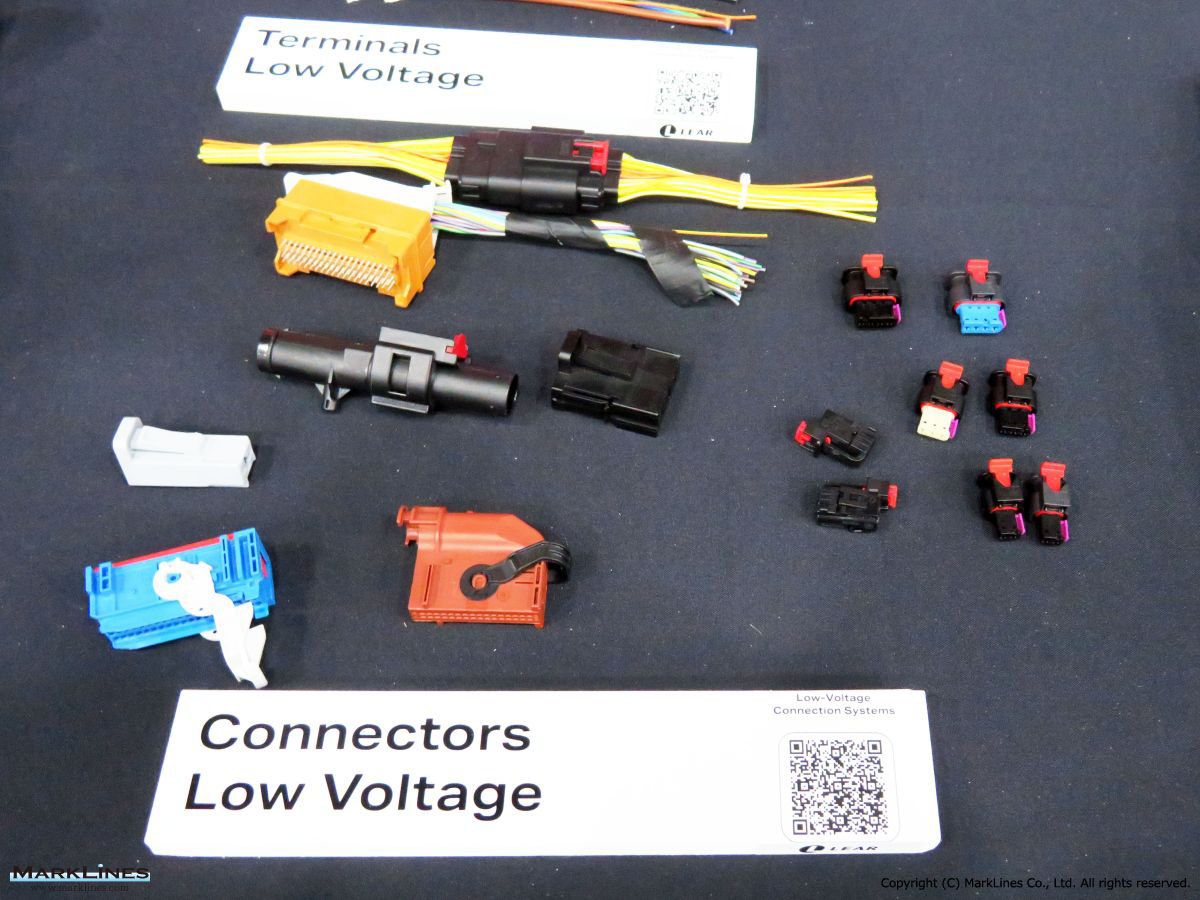

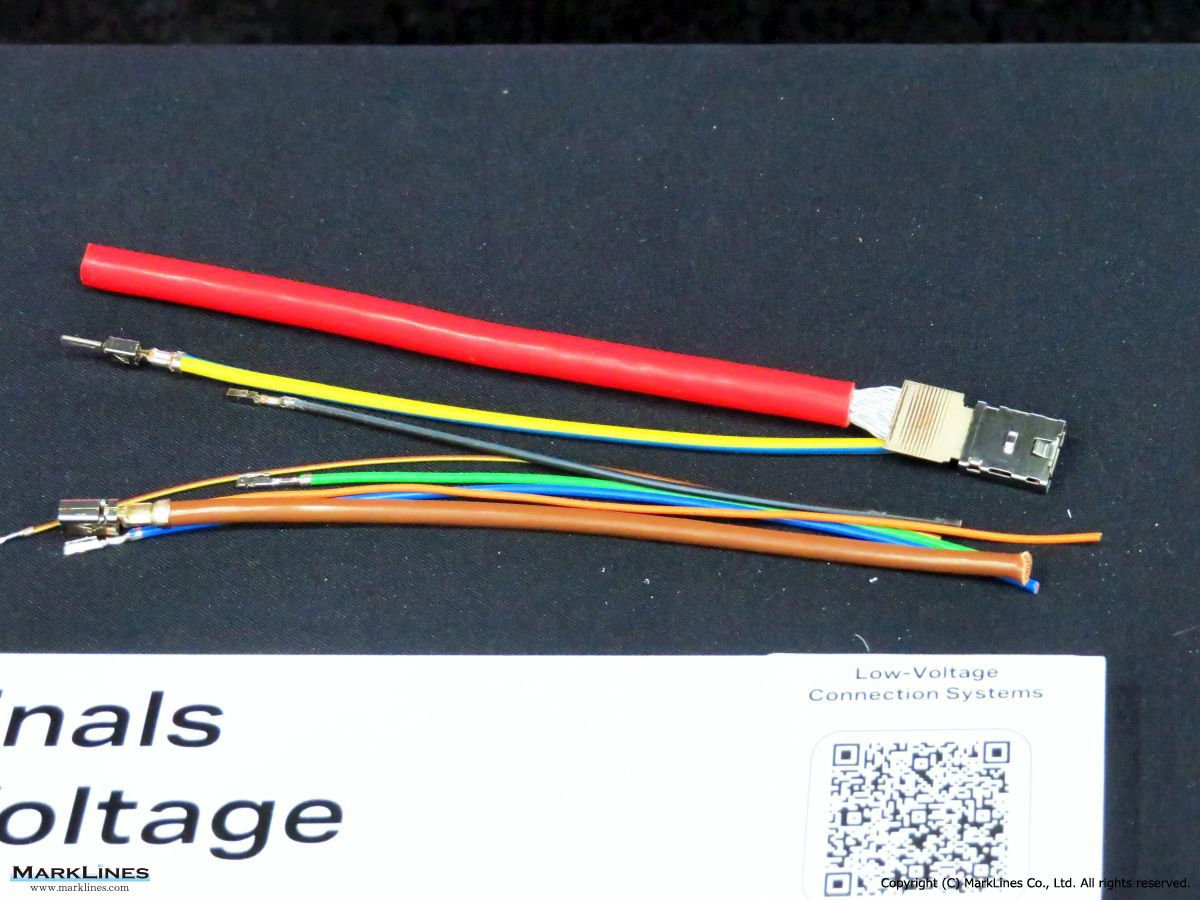

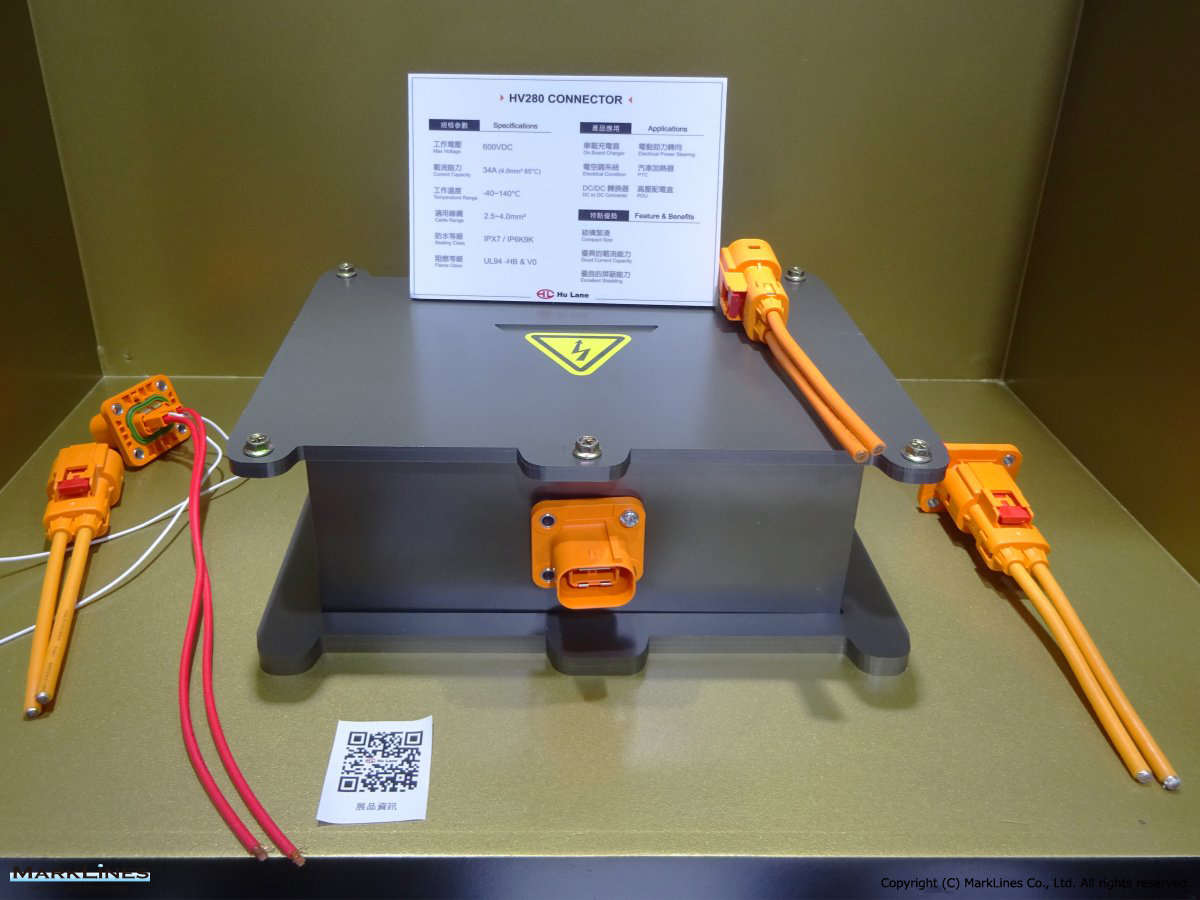

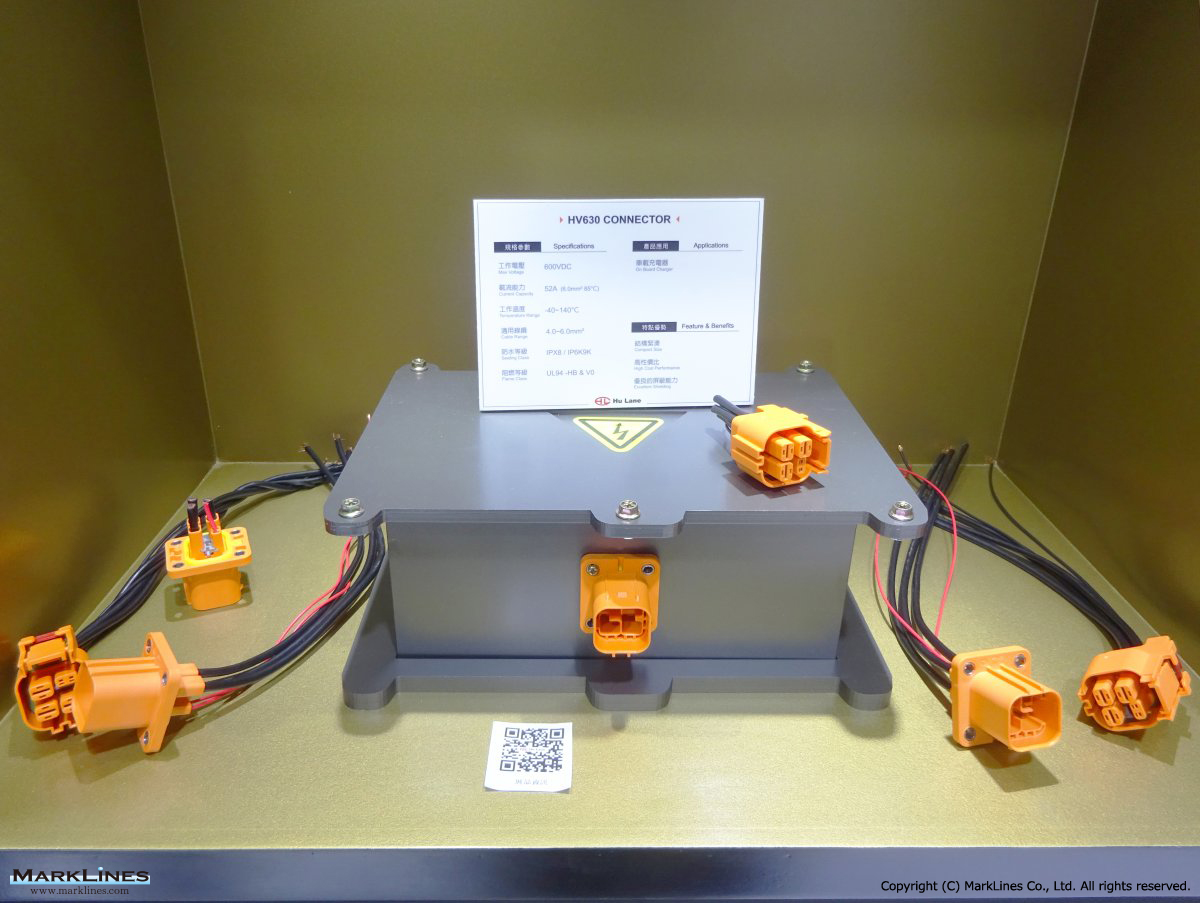

-Connection systems

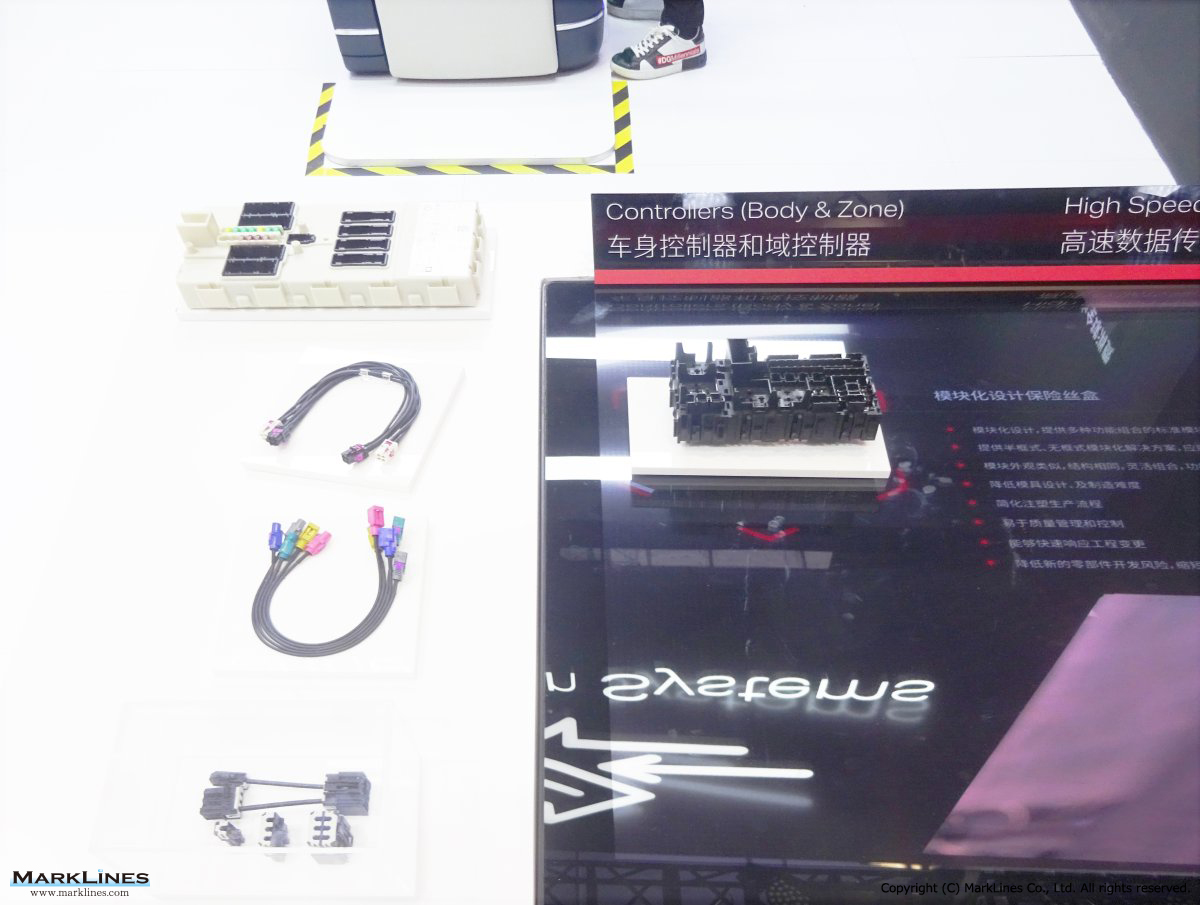

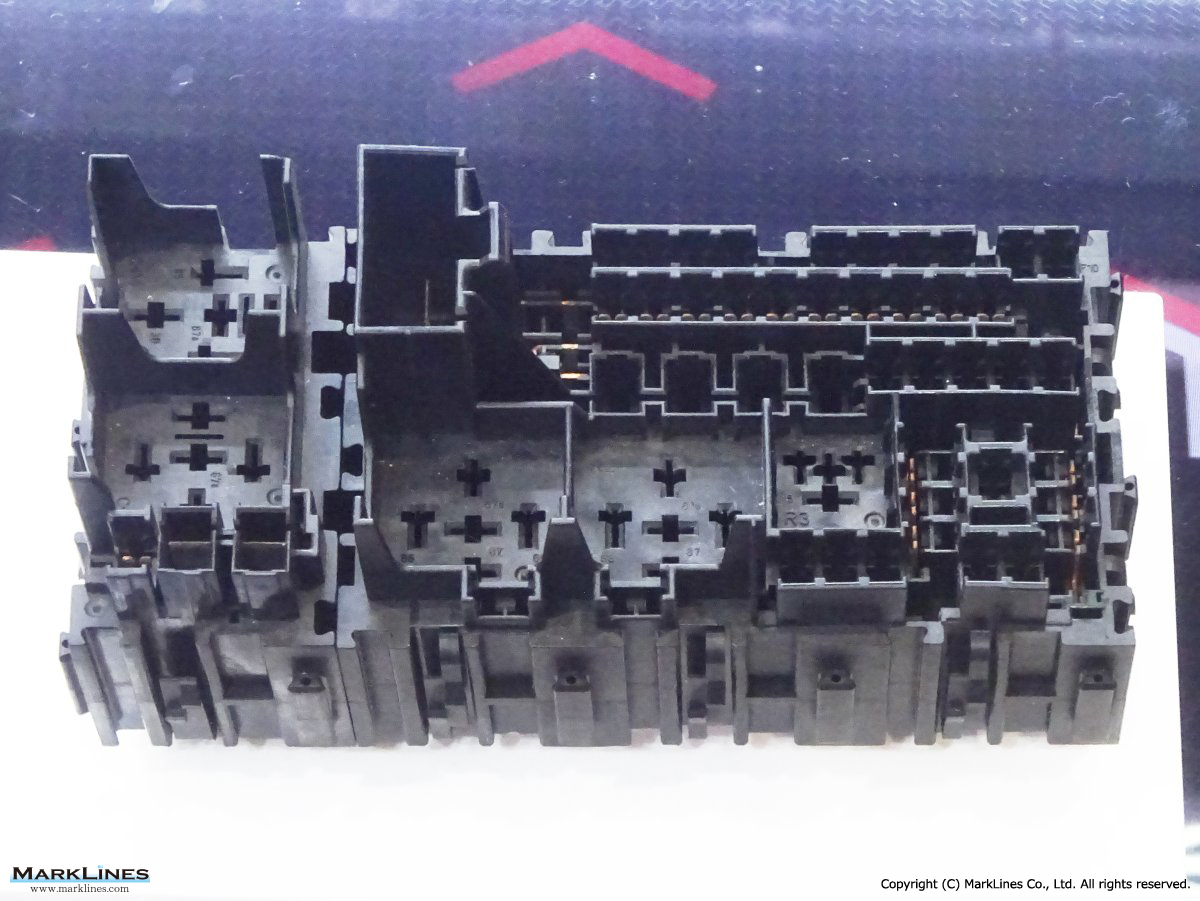

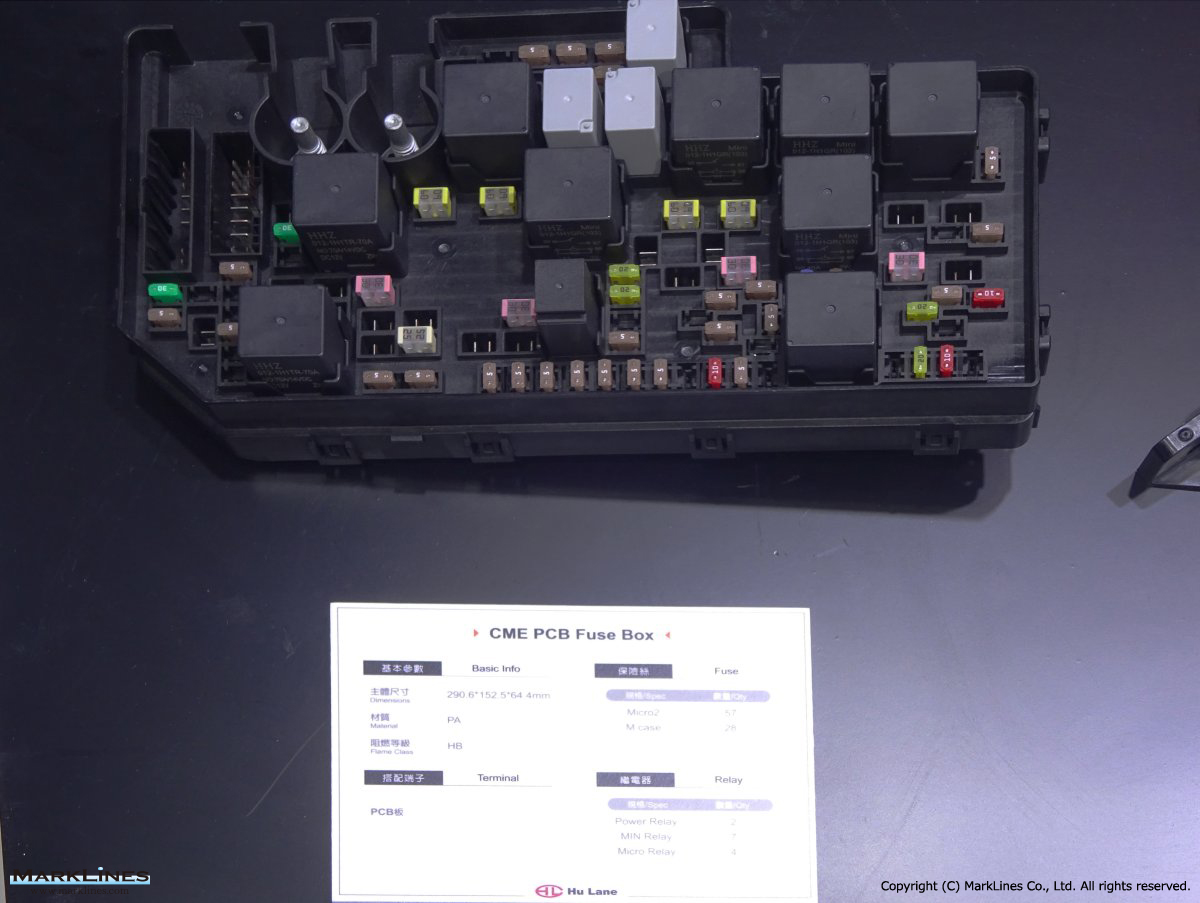

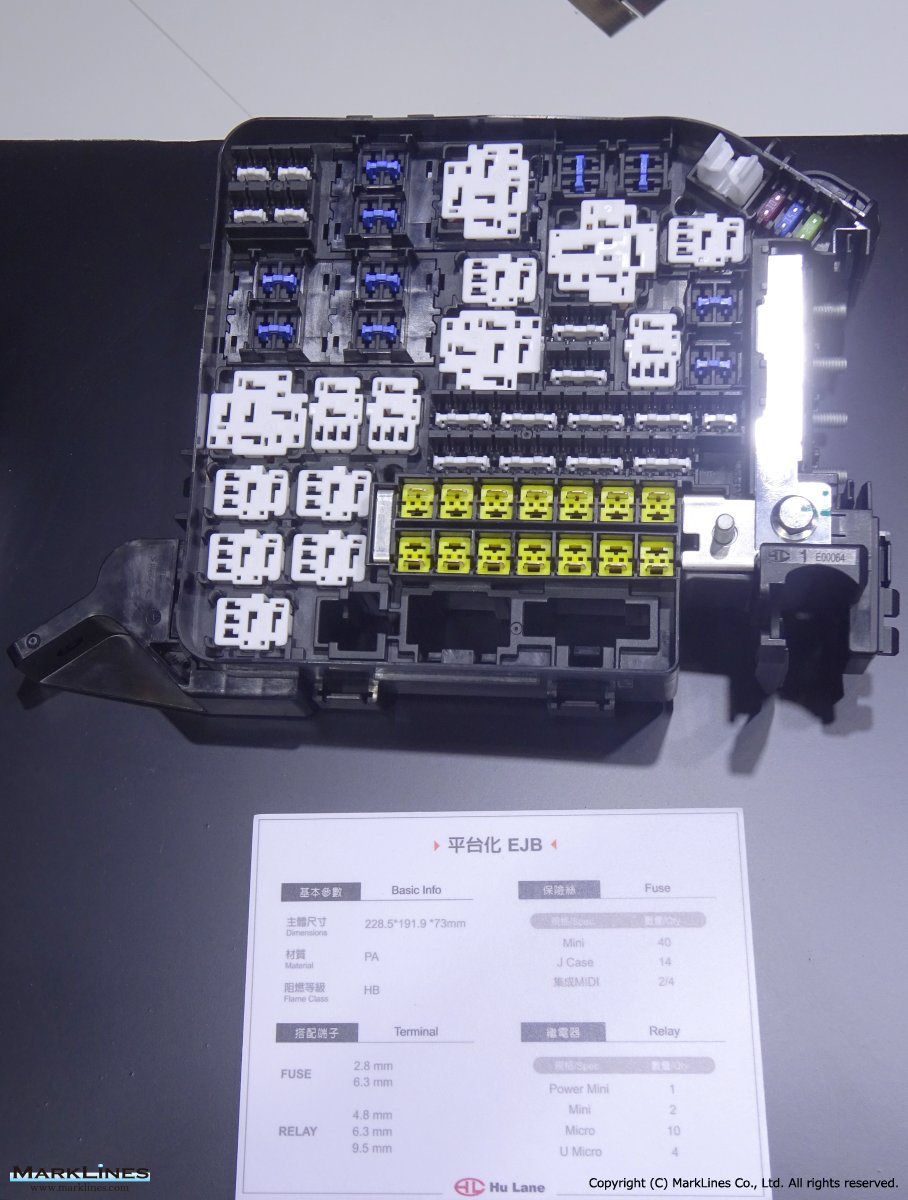

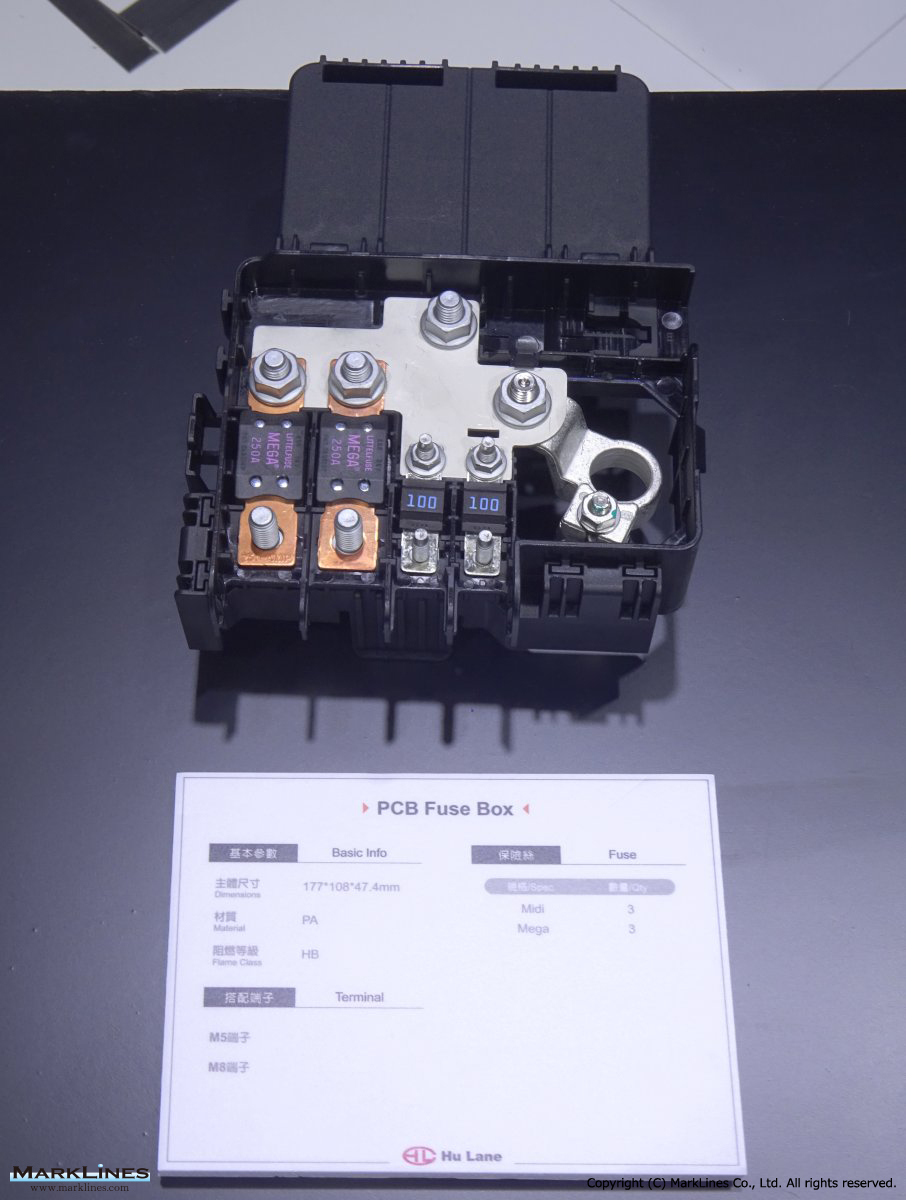

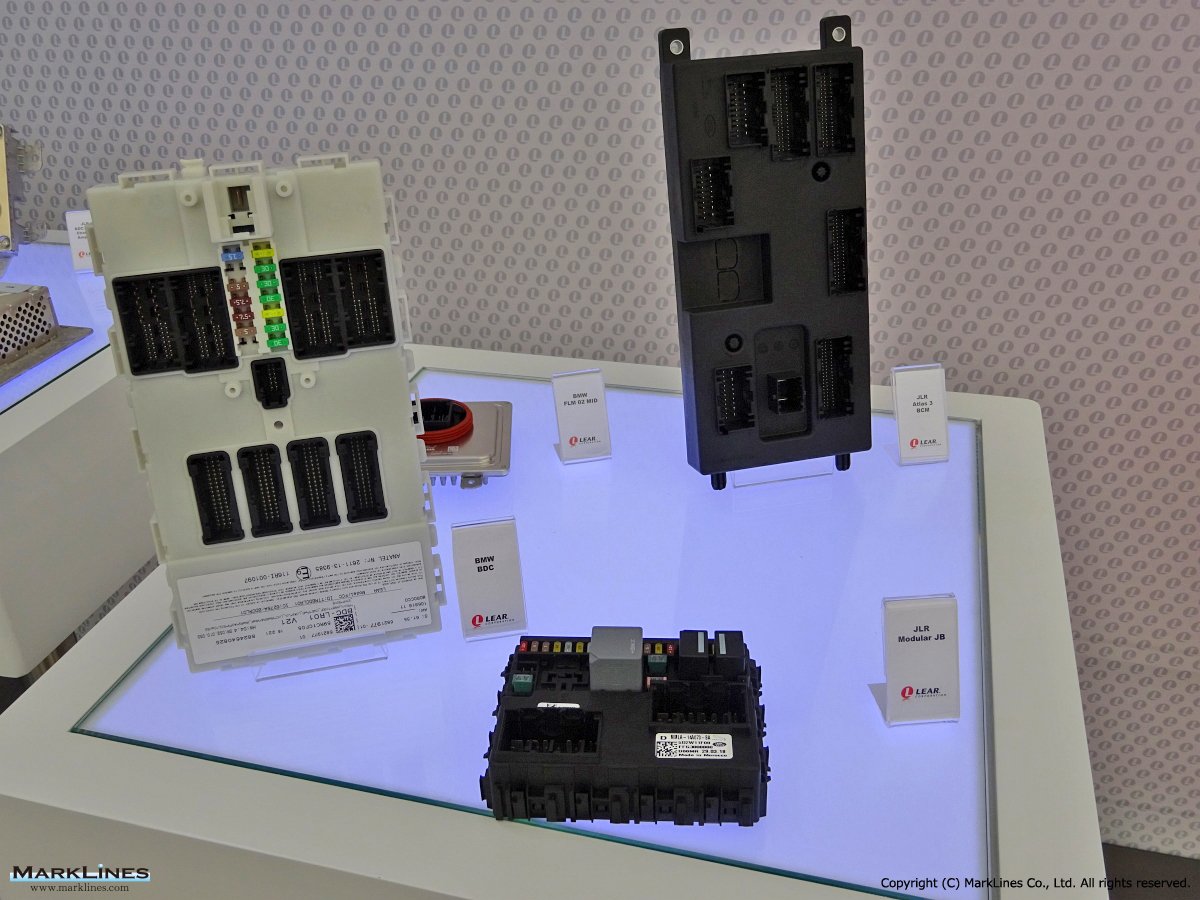

-Integrated power modules

-Smart junction boxes

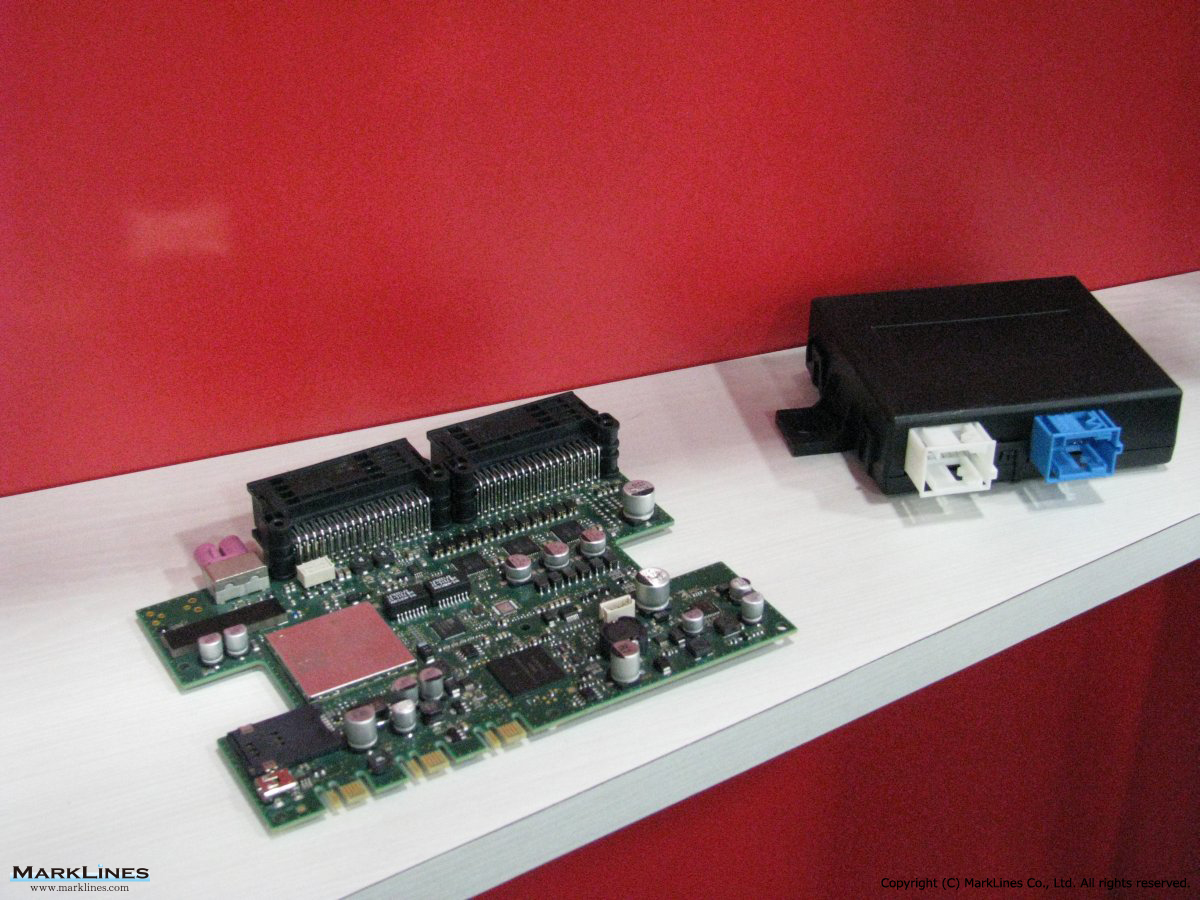

-Body domain controllers

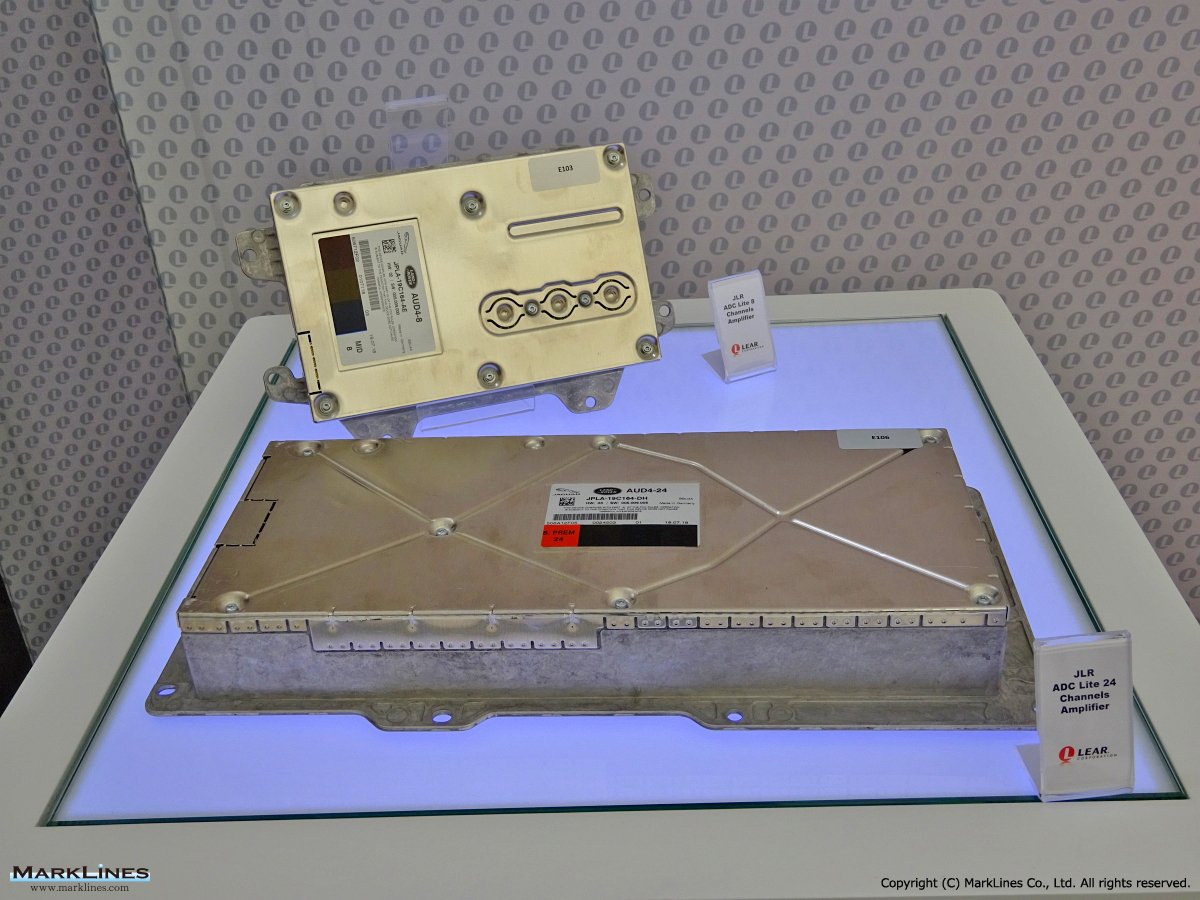

-Audio domain controllers

-Zone control modules

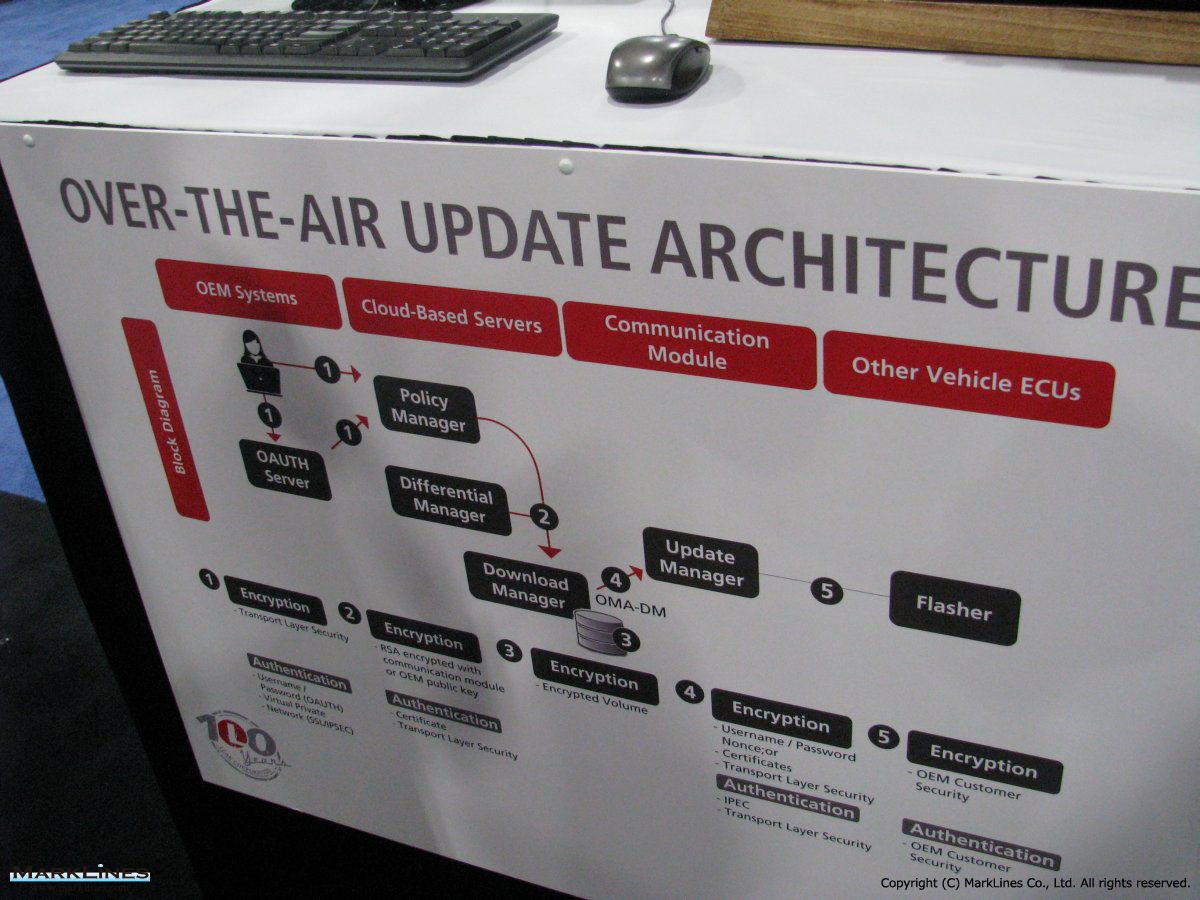

-Advanced software

-Terminals

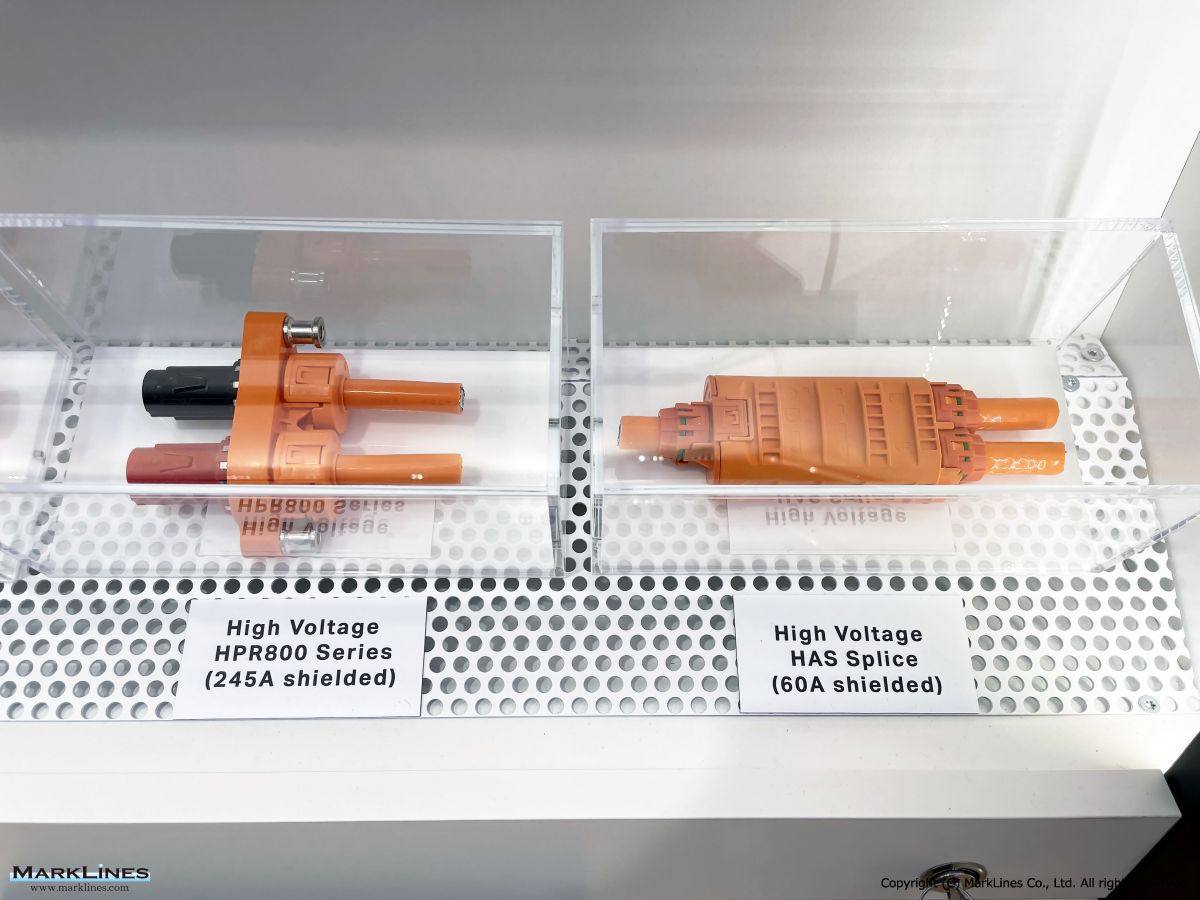

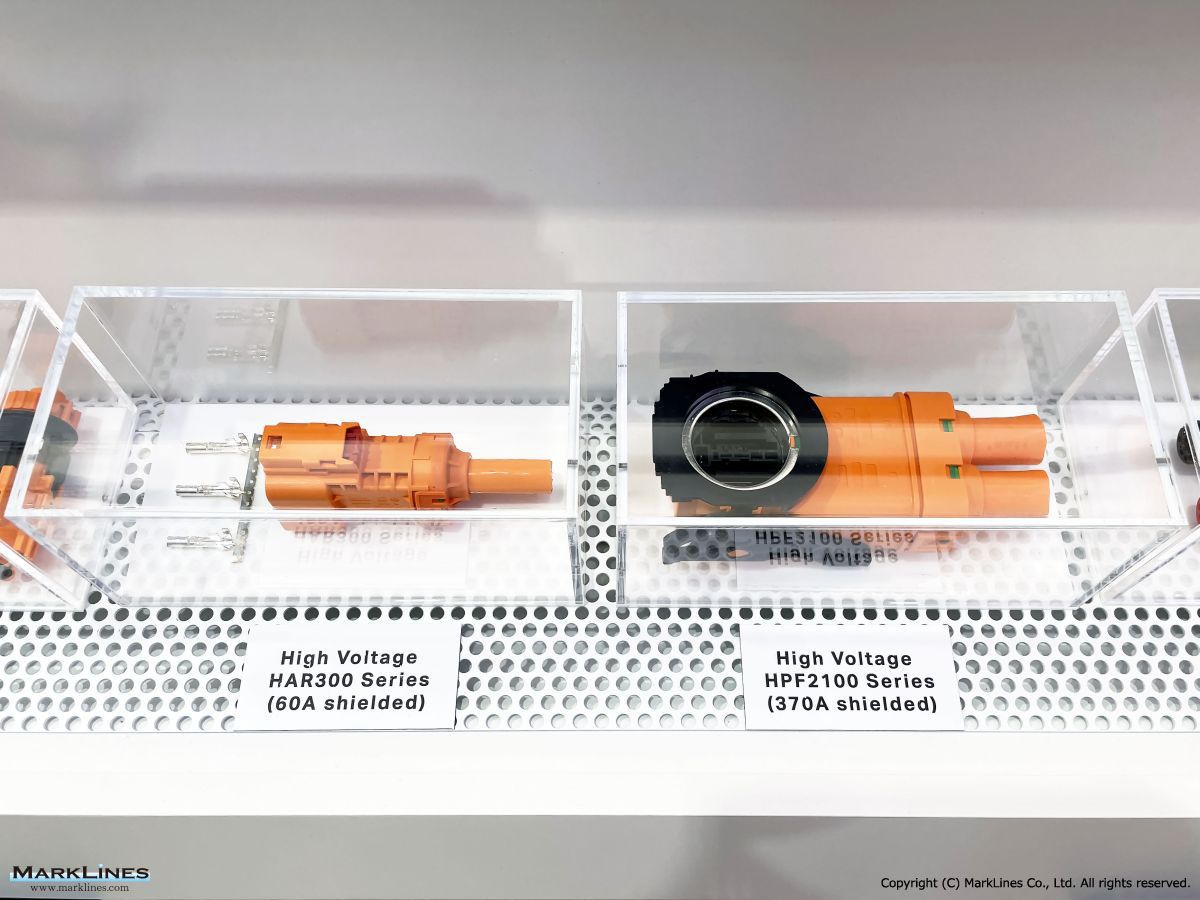

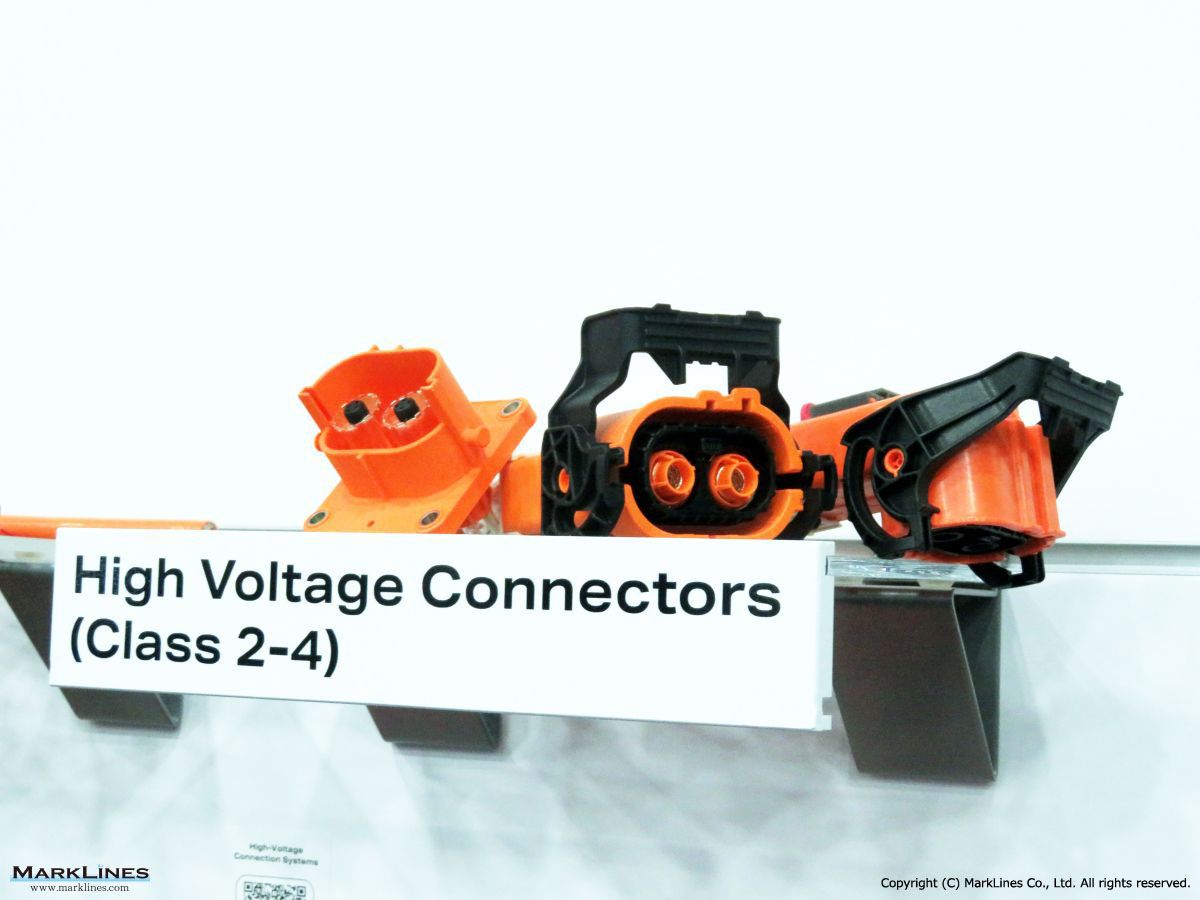

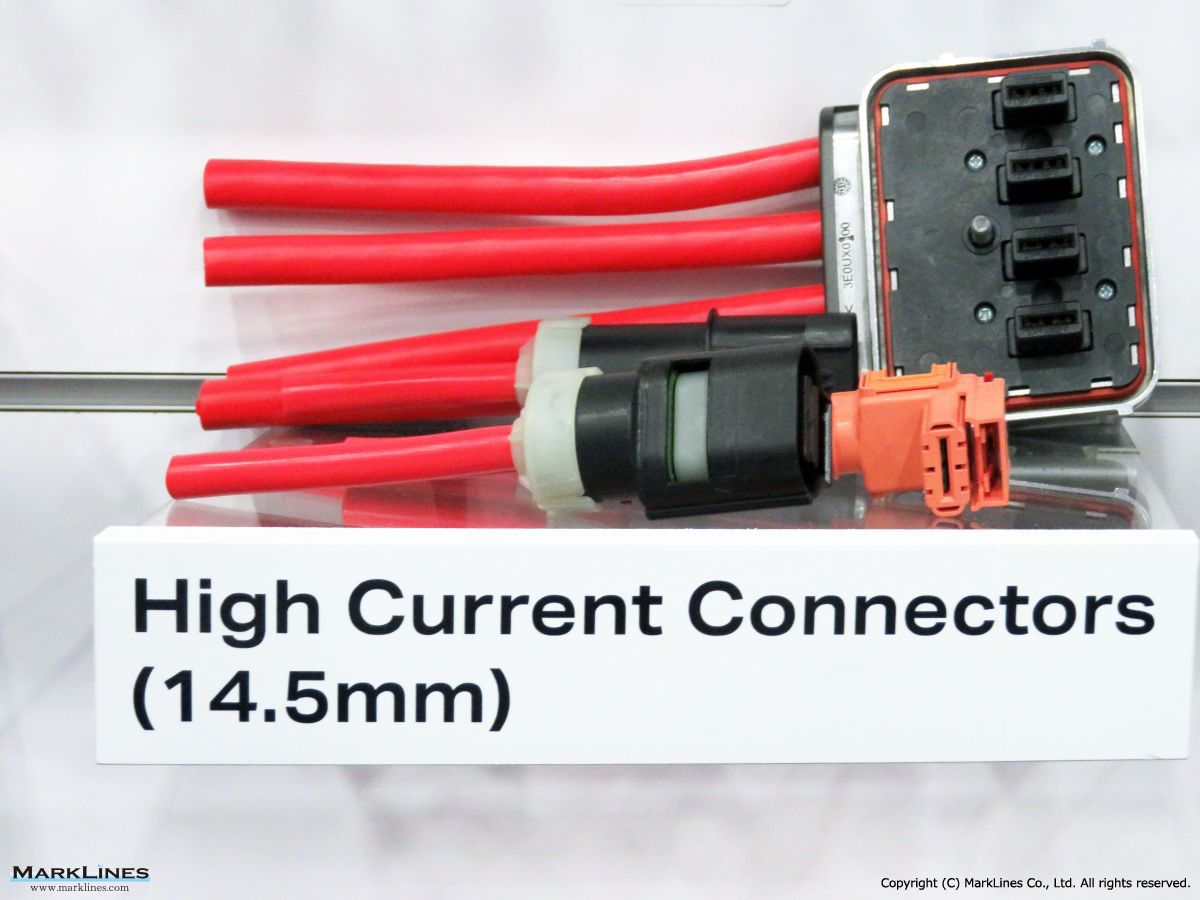

-Connectors

-Power distribution units

-Eyelets

-Seals

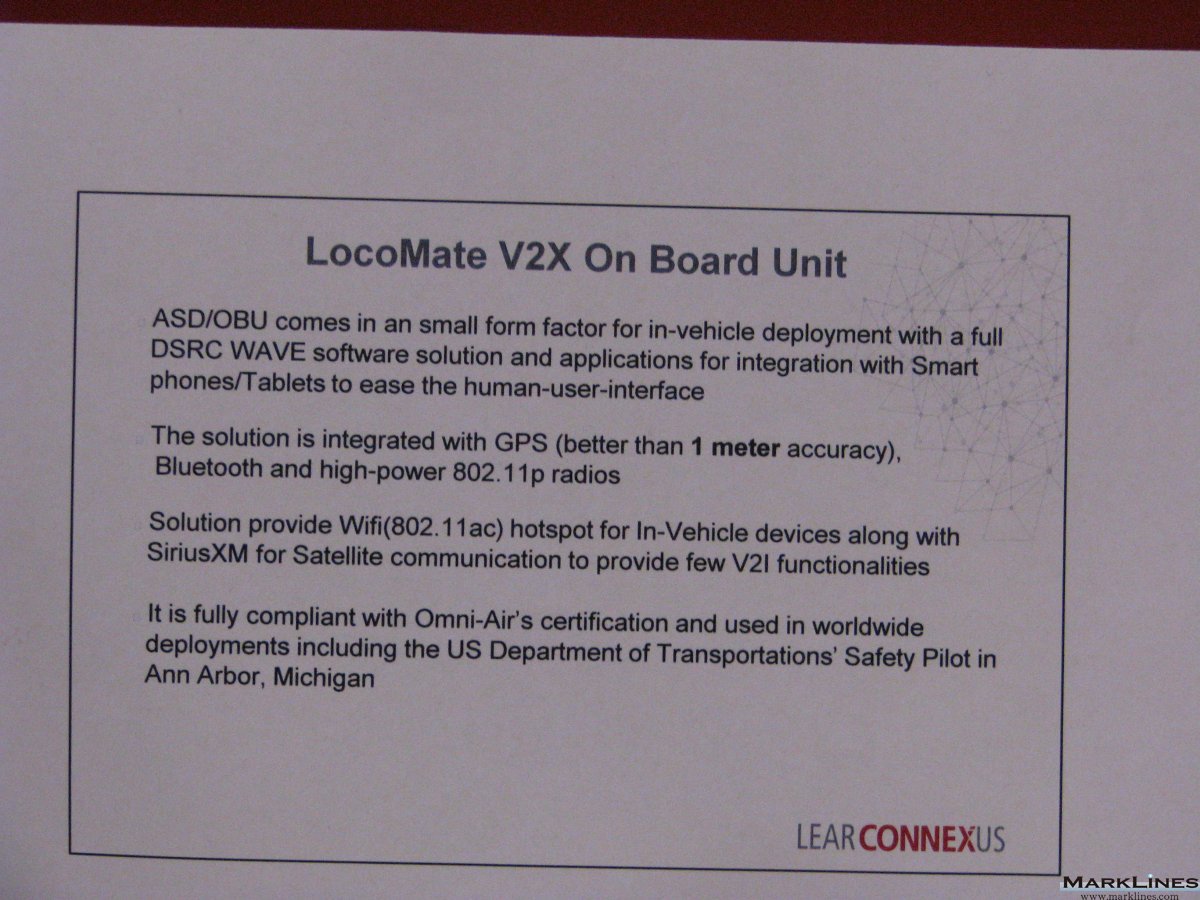

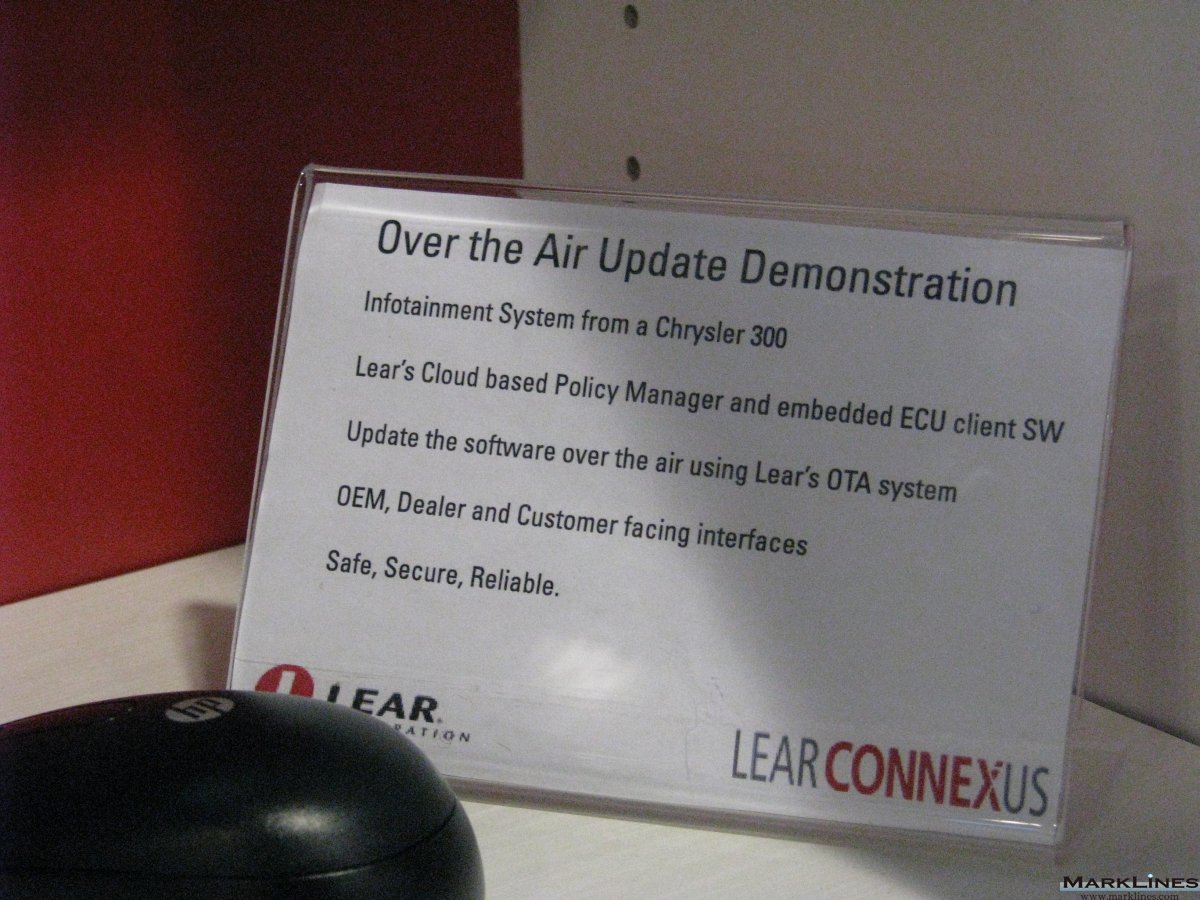

-TCUs

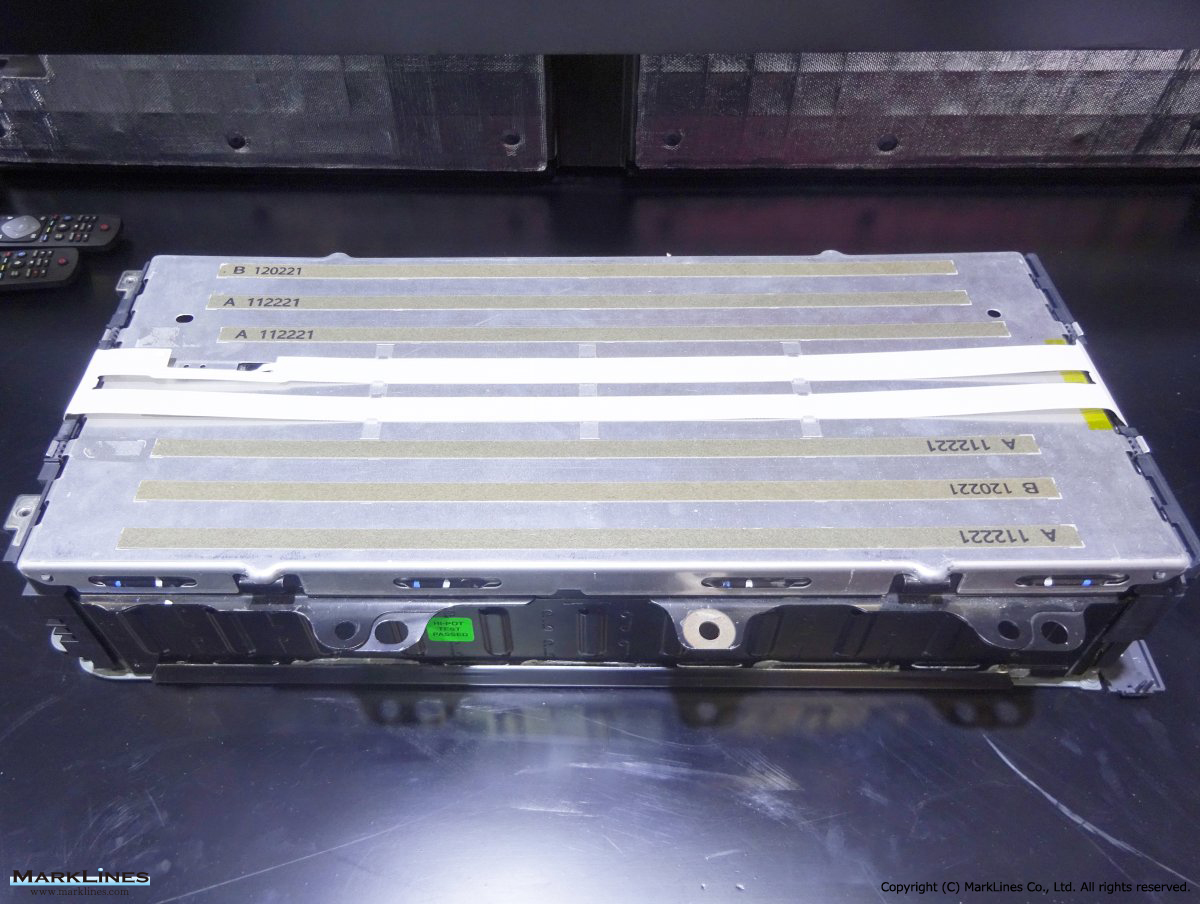

-Battery disconnect units

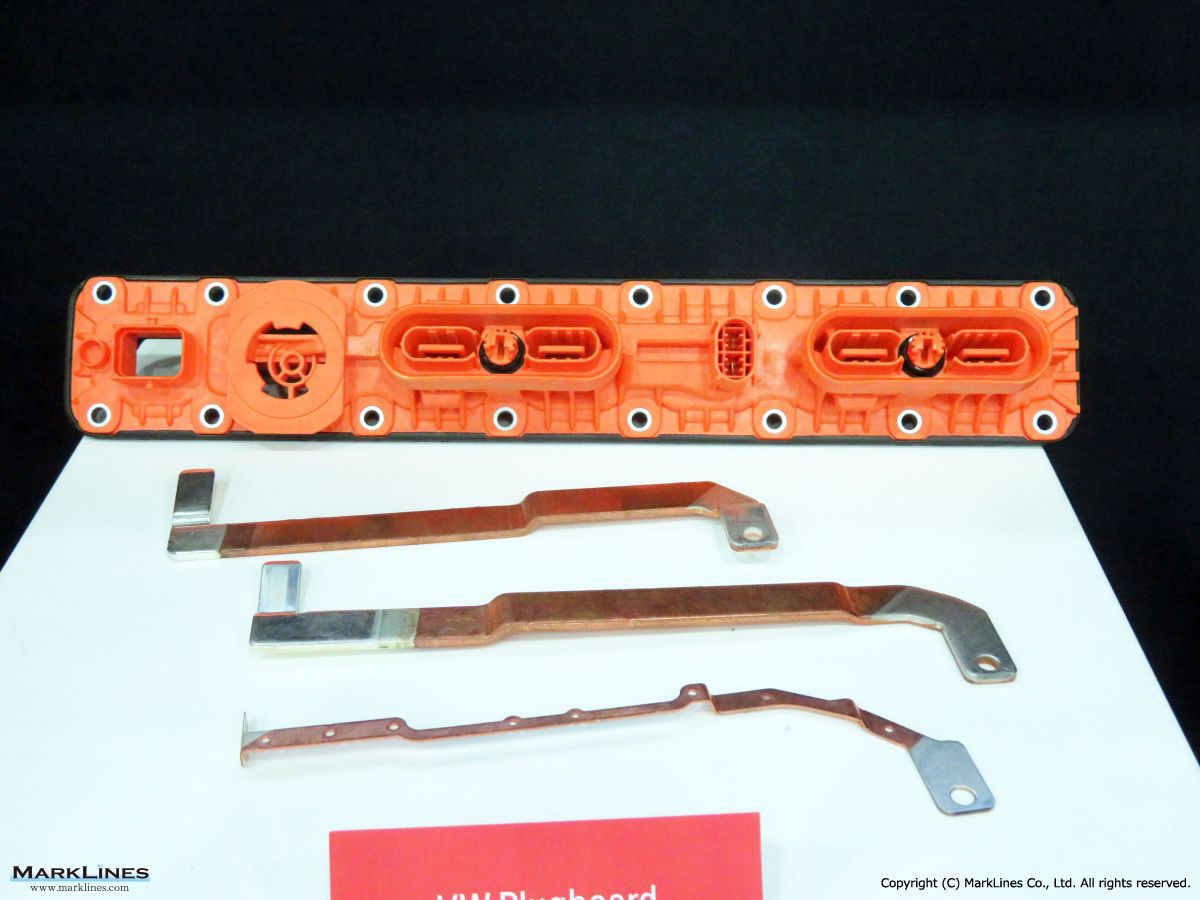

-High-voltage battery connection systems

History

| 1917 | Established as "American Metal Products Corporation" in Detroit, USA. |

| Nov. 1993 | Purchased certain assets of the Plastics and Trim Products Division of Ford Motor Co. that supply seat trim and trimmed seat assemblies to Ford. |

| Dec. 1993 | Merged with parent company, Lear Holdings Corporation, to form new entity. |

| Dec. 1994 | Acquired SEPI S.p.A. from Gilardini S.p.A. |

| Jun. 1995 | Acquired approximately 97% of Masland Corporation. Formed a joint venture, Lear Seating Inespo Industrial Do Brasil L.T.D.A. in Brazil. |

| Aug. 1995 | Acquired Automotive Industries Holding, Inc. |

| Oct. 1995 | Formed a joint venture, Lear Seating Do Brasil in Brazil. |

| Dec. 1996 | Acquired Borealis Industrier AB, a western European supplier of instrument panels, door panels and other automotive components, from Borealis Holding AB. |

| Jun. 1997 | Acquired Dunlop Cox Limited. |

| Jul. 1997 | Acquired certain equity and partnership interests in Keiper Car Seating GmbH & Co. and certain of its subsidiaries and affiliates. |

| Aug. 1997 | Acquired the Automotive Seat Sub-Systems Unit of ITT Automotive. |

| Sep. 1998 | Acquired the seating business of Delphi Automotive Systems. |

| Feb. 1999 | Acquired Polovat and the automotive business of Ovatex. |

| Apr. 1999 | Purchased certain assets of Peregrine Windsor, Inc., a division of Peregrine Incorporated. |

| May 1999 | Acquired UT Automotive Inc., a wholly-owned operating segment of United Technologies Corporation. |

| Jun. 1999 | Sold Electric Motor Systems (EMS) to Johnson Electric Holdings Limited. |

| Sep. 1999 | Purchased Donnelly Corporation's 50% interest in Lear-Donnelly Overhead Systems, L.L.C., the joint venture in which the two suppliers had been partners. |

| May 2000 | Formed a joint venture with Motorola, Inc. |

| Jun. 2000 | Sold its sealants and foam rubber business to AcoustiSeal. |

| Nov. 2000 | Formed Total Interior Systems - America, a joint venture with Takashimaya Nippatsu Kogyo Co., Ltd. |

| Dec. 2000 | Sold four European plastic and metal manufacturing facilities. |

| 2000 | Sold its interests in North American Interiors, L.L.C., Pianfei Glass S.A., Autoform Kunstoffteile GmbH and Autoform Kunstoffteile GmbH & Co. KG. |

| Feb. 2002 | Formed a comprehensive business partnership with Mitsubishi Cable Industries, Ltd. in the automotive wire harness business. |

| Apr. 2002 | Announced the formation of Nanjing Lear Xindi Automotive Interiors System Co., Ltd. (Lear Xindi), a joint venture with the Xindi subsidiary of Yuejin Motor Group Corporation. |

| 2006 | Decided to exit the interior business and completed the divestiture of European interior business. |

| Mar. 2007 | Completed the divestiture of its interior business. |

| Jul. 2009 | The Company, along with certain U.S. and Candian subsidiaries, filed for Chapter 11 bankruptcy protection. |

| Nov. 2009 | The Company emerged from Chapter 11 bankruptcy protection. |

| May 2012 | Acquired Guilford Mills, a manufacturer of fabrics for the automotive and specialty markets. |

| Jan. 2015 | Acquired Eagle Ottawa, a manufacturer of automotive leather, for USD 850 million. |

| Aug. 2015 | Acquired intellectual property and technology from Autonet Mobile, a developer of software and devices for automotive applications. |

| Nov. 2015 | Acquired Arada Systems, an automotive technology company which focuses on V2V and V2I communications. |

| Dec. 2016 | Acquired AccuMED Holdings Corp., a privately-held developer and manufacturer of specialty fabrics. |

| Apr. 2017 | Completed acquisition of Grupo Antolin’s seating business for EUR 286 million. |

| Dec. 2017 | Entered agreement to acquire EXO Technologies, a GPS technology specialist which provides high-accuracy solutions for autonomous and connected vehicle applications. |

| Jan. 2018 | Completed acquisition of EXO Technologies. |

| Apr. 2019 | Acquired Xevo Inc., a supplier of software solutions for the cloud, vehicles and mobile devices. |

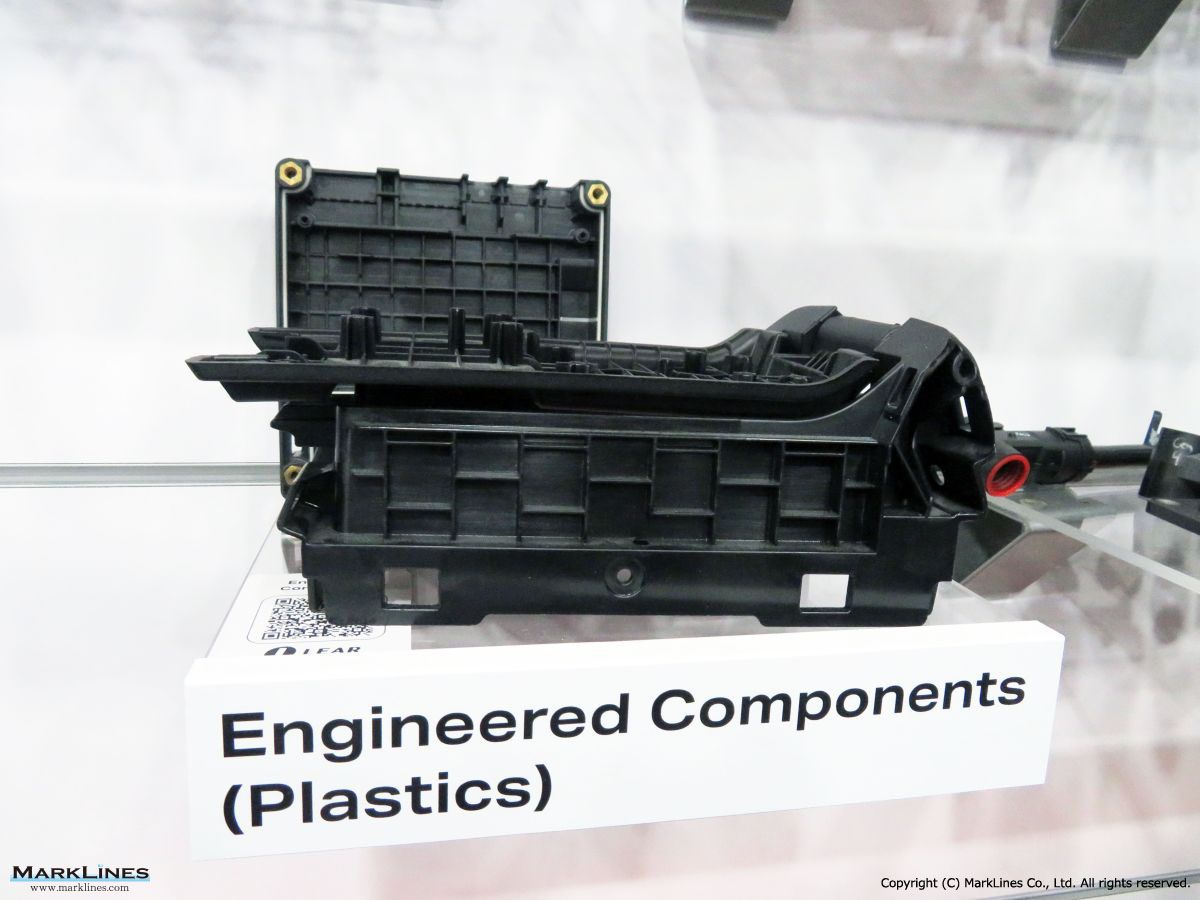

| Mar. 2021 | Acquired M&N Plastics, an injection molding specialist and manufacturer of engineered plastic components for automotive electrical distribution applications. |

| Feb. 2022 | Completed acquisition of Kongberg Automotive’s Interior Comfort Systems business unit, which specializes in thermal and comfort seating solutions, for USD 198 million. |

| Mar. 2022 | Completed acquisition of Thagora Technology SRL. |

| Nov. 2022 | Completed acquisition of InTouch Automation. |

| Apr. 2023 | Completed acquisition of I.G. Bauerhin. |

| Jul. 2024 | Completed acquisition of WIP Industrial Automation. |

| Feb. 2025 | Completed acquisition of StoneShield Engineering. |

Supplemental Information 1

>>>Business report FY ended Dec. 31, 2006

>>>Business report FY ended Dec. 31, 2007

>>>Business report FY ended Dec. 31, 2008

>>>Business report FY ended Dec. 31, 2009

>>>Business report FY ended Dec. 31, 2010

>>>Business report FY ended Dec. 31, 2011

>>>Business report FY ended Dec. 31, 2012

>>>Business report FY ended Dec. 31, 2013

>>>Business report FY ended Dec. 31, 2014

>>>Business report FY ended Dec. 31, 2015

>>>Business report FY ended Dec. 31, 2016

>>>Business report FY ended Dec. 31, 2017

>>>Business report FY ended Dec. 31, 2018

>>>Business report FY ended Dec. 31, 2019

>>>Business report FY ended Dec. 31, 2020

>>>Business report FY ended Dec. 31, 2021

>>>Business report FY ended Dec. 31, 2022

>>>Business report FY ended Dec. 31, 2023

Archives of Past Exhibits

Note: A figure in brackets ( ) indicates a loss

Japan

Japan USA

USA Mexico

Mexico Germany

Germany China (Shanghai)

China (Shanghai) Thailand

Thailand India

India