thyssenkrupp AG (Formerly ThyssenKrupp AG) Business Report FY ended Sep. 2017

Financial Overview |

(in million EUR) |

| FY ended Sep. 30, 2017 | FY ended Sep. 30, 2016 | Rate of change (%) |

Factors | |

| Overall | ||||

| Sales | 42,971 | 39,263 | 9.4 | 1) |

| EBIT | 687 | 1,189 | (42.2) | - |

| Components Technology | ||||

| Sales | 7,571 | 6,807 | 11.2 | 2) |

| EBIT | 297 | 251 | 18.3 | - |

| Steel Europe | ||||

| Sales | 8,915 | 7,633 | 16.8 | 3) |

| EBIT | 493 | 316 | 56.0 | - |

Factors

1) Net Sales

-The Company’s net sales for the fiscal year ended September 30, 2017 increased by 9.4% to EUR 42,971 million. Most of the Company’s business areas had increased sales during the fiscal year including the Components Technology, Elevator Technology, Materials Service and Steel Europe business areas. The Company’s Industrial Solutions business area had decreased sales due weakened demand in mining and chemical plant engineering.

2) Components Technology

-In the fiscal year ended September 30, 2017, the Company’s Components Technology business area had net sales of EUR 7,571, an increase of 11.2% over the previous year. Despite decreased demand in the U.S. passenger vehicle segment, strong sales in Western Europe and China offset those losses. Strength in China and the U.S. contributed to increased sales in the commercial vehicle segment.

3) Steel Europe

-Net sales for the Company’s Steel Europe business area in the fiscal year ended September 30, 2017 increased 16.8% to EUR 8,915. The increase in sales was driven by an increase in sales volumes combined with an increase in steel prices.

Restructuring

-The Company announced plans to integrate its forging activities within its components business unit to form one of the world’s biggest forging organizations with sites in North America, South America, Europe, India and China. The new business unit, thyssenkrupp Forged Technologies, will start on October 1, 2018 with roughly 7,000 employees at 18 production sites and a broad distribution network in over 70 countries. The business unit will have sales of over EUR 1 billion and operate over 50 forging presses worldwide. It will be managed from the Company’s headquarters in Essen. The product portfolio includes forged and machined components and systems for the automotive and construction machinery sectors and for general mechanical engineering applications. The new unit comprises the previously independent business units Forging & Machining headquartered in Brazil, and Undercarriages located in Italy. (From a press release on October 4, 2017)

-In September 2017, the Company completed the sale of its CSA steel mill in Brazil to Ternium, a Latin American steelmaker, for EUR 1.5 billion. The sale of the CSA steel mill takes effect retrospectively from September 30, 2016. The closure of the sale marks the completion of the divestiture of the Company’s Steel Americas unit. The process began in 2014 with the sale of a processing plant to a consortium consisting of ArcelorMittal and Nippon Steel. (From a press release on September 7, 2017)

Joint Ventures

-The Company and Tata Steel Limited have signed a Memorandum of Understanding to create a leading European steel enterprise by combining the flat steel businesses of the two companies in Europe and the Company’s steel mill services. The proposed 50:50 joint venture - Thyssenkrupp Tata Steel - would be focused on quality and technology leadership, and on the supply of premium and differentiated products to customers, with annual shipments of about 21 million tonnes of flat steel products. The joint venture would have a pro forma turnover of approximately EUR 15 billion per annum and employ 48,000 people. Its headquarters would be located in Amsterdam, Netherlands. (From a press release on September 20, 2017)

Contracts

-The Company’s subsidiary, thyssenkrupp System Engineering, received an order from the Chinese automotive manufacturer SAIC-GM-Wuling for the manufacture and delivery of body stamping dies for a new vehicle generation. Under the contract, the Company will plan, design and manufacture tools for the production of exterior body parts, including fenders, doors and side panels, for the new CN300M SUV. Additionally, the two companies have concluded a joint agreement to explore further, long term cooperation in the field of automotive manufacturing technology. In 2019, SAIC-GM-Wuling plans to produce approximately 150,000 CN300M models per year. (From a press release on July 12, 2017)

Awards

-The Company’s steering systems business received the World Excellence Award in the Special Recognition category from Ford, acknowledging the Company’s performance in development and customer support.

-The Company’s steering system business won the 2017 Volkswagen Group Award in the Global Champion category due to its successful product launches, the construction of new plants in China and Mexico, its global localization strategy and the management of projects for Volkswagen and Audi.

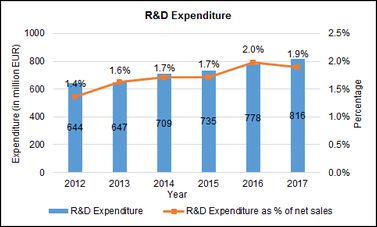

R&D Expenditure |

(in million EUR) |

| FY ended Sep. 30, 2017 | FY ended Sep. 30, 2016 | FY ended Sep. 30, 2015 | |

| Total | 816 | 778 | 735 |

-One of the keys to the Company’s long-term growth strategy is its investment in research and development. Despite uneven sales and earnings since the fiscal year ended September 30, 2012, the Company has increased its overall R&D expenditure every year.

-One of the keys to the Company’s long-term growth strategy is its investment in research and development. Despite uneven sales and earnings since the fiscal year ended September 30, 2012, the Company has increased its overall R&D expenditure every year.

R&D Structure

-As of September 30, 2017, the Company has approximately 4,500 employees working in research and development across 90 locations.

R&D Facilities

-The Company’s subsidiary, thyssenkrupp Presta North America (thyssenkrupp Steering), announced that it is investing more than USD 7 million to create a new 37,000-square-foot technology center in Fishers, Indiana, U.S. The new facility will allow thyssenkrupp Steering to develop technologies to aid in the comfort and safety of steering as well as advance solutions to improve fuel economy and reduce carbon emissions. The technology center is expected to be fully operational by the spring of 2018. Once completed, the center will house the Company's engineering operations currently located in Indianapolis. The center will complement the manufacturing facility in Terre Haute, Indiana and the sales and technical office in Troy, Michigan. (Indiana Economic Development Corporation release on December 19, 2017)

-The Company’s newly opened TechCenter Additive Manufacturing in Mulheim an der Ruhr, Germany, has now started making customized products from metals and plastics in a single digital process. The Company aims to use its existing experience and research partnerships to unlock the potential of 3D printing for customers within a short space of time. Key markets such as engineering, aerospace, naval shipbuilding and automotive will particularly benefit from this technology. (From a press release on September 1, 2017)

-The Company began construction on a new test and development center for steering technology near its steering business headquarters in Eschen, Liechtenstein. Completion of the EUR 15 million project is planned to occur in the first half of 2019. The 3,000-square-meter test center will concentrate the Company’s competencies in the development and prototyping of electric power-assisted steering systems. (From a press release on January 20, 2017)

-During the fiscal year ended September 30, 2017, the Company established the Advanced Robotics Lab in Liechtenstein. The Company will use the Advanced Robotics Lab to develop control systems that enables robots to flexibly respond to feedback.

Product Development

Highly integrated electric drive axle

-The Company is developing a highly integrated electric drive axle at its E-mobility competence center in Liechtenstein. The electric axle will include an electric motor, transmission, power electronics and a newly designed stator.

Thin electrical steel

-The Company has developed a new type of electrical steel with a thickness of 0.35 millimeters. The low thickness of the electrical steel reduces losses from eddy currents, thus enhancing the efficiency of electric motors.

Lightweight steel enclosures for electric car batteries

-The Company has developed new lightweight steel enclosures for electric car batteries. The enclosures are crash- and corrosion-resistant and provide electromagnetic shielding at approximately half the cost of aluminum-based solutions.

Patents

-As of September 30, 2017, the Company has approximately 19,000 patents.

Capital Expenditures |

(in million EUR) |

|

|

FY ended Sep. 30, 2017 | FY ended Sep. 30, 2016 | FY ended Sep. 30, 2015 |

| Overall | 1,666 | 1,387 | 1,235 |

| -Components Technology | 551 | 488 | 392 |

| -Steel Europe | 566 | 400 | 458 |

-The Company’s investments in the Components Technology business area focused on supporting existing facilities and expanding production capacity for electric steering systems, specifically in China, Mexico and Hungary. The Company constructed a new plant in Mexico and expanded a plant in Romania that manufactures active and passive damping systems. The Company is in the process of developing two new highly automated plants in Hungary and China for the production of springs and stabilizers. Finally, the Company expanded production capacity of cylinder head modules in plants in China, Europe and Mexico.

-A significant percentage of the Company’s investments in the Steel Europe business area was dedicated towards relining a blast furnace at HKM. The blast furnace restarted operations in the second quarter of the fiscal year and enables the production of high-quality grade steel. The Company also acquired a heat and power plant in Duisburg-Hamborn.

Investments in Germany

-The Company announced that it opened a new production shop for steering components at its Schoenebeck site in Saxony-Anhalt. Starting in 2018, the site will produce ball screws for electric power steering systems in the 3,000-square-meter shop. The plant expansion will create 65 new jobs. The new shop represents the start of the planned step-by-step expansion of the Schoenebeck production facility in the future. The project has received funding of EUR 1.5 million from the state of Saxony-Anhalt towards the total investment of approximately EUR 10 million. (From a press release on October 25, 2017)

-The pickling line for hot-rolled steel at the Company’s Duisburg-Huttenheim site has been modernized to improve product quality and prolong the life of the facility. The unit went into operation 22 years ago. The pickling baths and its ancillary equipment have been upgraded and are now completely composed of plastic, with the result that the Duisburg-Sud works unit now has a state-of-the-art pickling facility. The Company’s steel division has invested a total of EUR 17 million in this program for the Duisburg-Sud site. (From a press release on January 31, 2017)

Investments outside Germany

-The Company has opened a new EUR 10 million development center for engine components in Dalian, China. The new 2,000-square-meter development center is situated on the grounds of an existing production site in Dalian which has manufactured assembled camshafts and cylinder head cover modules since 2005. The new development center will focus on the development of innovative valve train products specifically for the Chinese market. Driven by new customer orders, the Company has invested over EUR 300 million in expanding its component production network in China in the past three years. (From a press release on April 24, 2017)

-The Company is expanding its automotive components business in China with a EUR 30 million investment in a new plant for springs and stabilizers in Pinghu, China. Construction will start in 2017, with production starting in 2018. The plant will produce approximately five million springs and stabilizers per year. The customer list for the plant’s output includes European, American, Japanese and Chinese OEMs. The new plant will be the Company's third plant for springs and stabilizers in China. (From a press release on January 23, 2017)

-The Company will build an automotive components plant in Hungary. Construction of the EUR 35 million plant on a 20,000-square-meter site in Debrecen will start in spring 2017. More than six million coil springs and stabilizers will be produced annually beginning in 2018. (From a press release on February 3, 2017)

Japan

Japan USA

USA Mexico

Mexico Germany

Germany China (Shanghai)

China (Shanghai) Thailand

Thailand India

India