Analysis Report: Thermal Management of BEV Batteries (Europe, U.S. and China Markets)

Searching for battery cooling methods to reduce costs

List of Suppliers

| Valeo | Mahle Behr | Hanon Systems | Modine Manufacturing |

| TI Automotive Limited | FinDreams | Ningbo Tuopu | Xiezhong International Thermal Management |

| Zhejiang Sanhua Automotive | Denso | Marelli, Highly-Marelli |

See Analysis Report: Lithium-Ion Battery (China)

Introduction

This report outlines future trends in thermal countermeasures (thermal management) for lithium-ion batteries in BEVs (battery electric vehicles) and the status of each supplier. Thermal countermeasures are also applied to the e-Axle (motor, inverter, and reducer) of hybrid vehicles (HV), plug-in hybrid electric vehicles (PHEV), and BEVs, but these parts are excluded from the scope of this report. The target markets are Europe, the U.S., and China, where BEV sales are growing, while information on Japan is for reference only.

According to the MarkLines survey, annual BEV sales in 2024 in a total of 14 countries (11 major countries and the three Nordic countries of Norway, Sweden, and Finland) were up 10.2% from the previous year to 10.3 million units. BEV sales have increased, as shown in the table below, but the rate of growth has slowed.

This breakdown shows a trade-off between growth in North America and a decline in Europe, especially in Germany, resulting in the increase in China alone contributing to the overall increase.

*11 major countries: China, USA, Japan, India, Germany, France, Brazil, UK, South Korea, Canada, Italy

| Country | 2024 | 2023 | Difference | |

|---|---|---|---|---|

| Japan | 40,230 | 68,459 | -28,229 | 58.8% |

| Korea | 143,436 | 138,947 | 4,489 | 103.2% |

| India | 92,056 | 104,393 | -12,337 | 88.2% |

| China | 7,095,774 | 6,179,057 | 916,717 | 114.8% |

| Finland | 21,738 | 29,459 | -7,721 | 73.8% |

| France | 316,123 | 323,428 | -7,305 | 97.7% |

| Germany | 377,845 | 519,882 | -142,037 | 72.7% |

| Italy | 69,211 | 72,301 | -3,090 | 95.7% |

| Norway | 114,248 | 104,281 | 9,967 | 109.6% |

| Sweden | 97,887 | 113,747 | -15,860 | 86.1% |

| UK | 393,742 | 326,585 | 67,157 | 120.6% |

| Brazil | 59,885 | 20,741 | 39,144 | 288.7% |

| Canada | 188,919 | 158,777 | 30,142 | 119.0% |

| USA | 1,285,841 | 1,183,439 | 102,402 | 108.7% |

| Total | 10,296,935 | 9,343,496 | 953,439 | 110.2% |

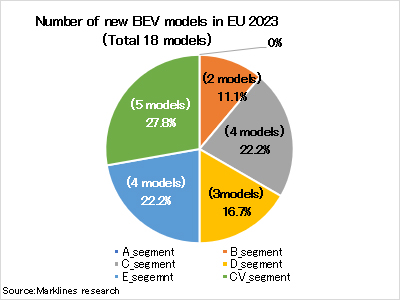

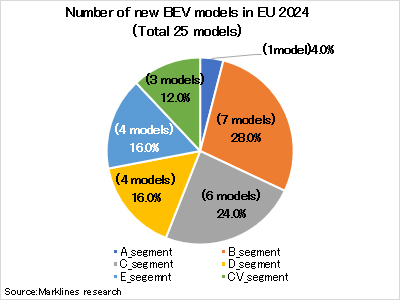

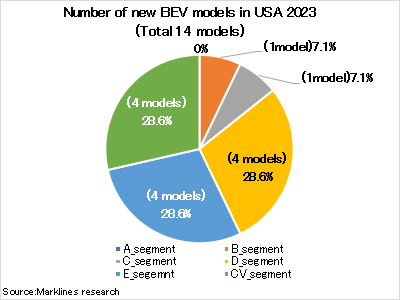

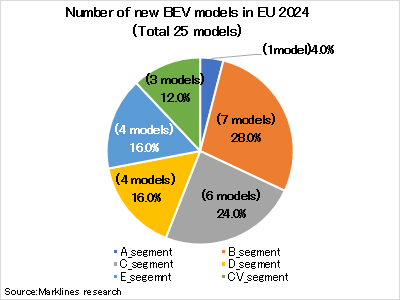

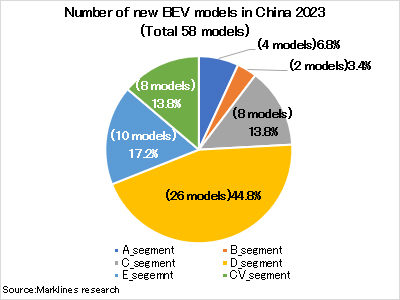

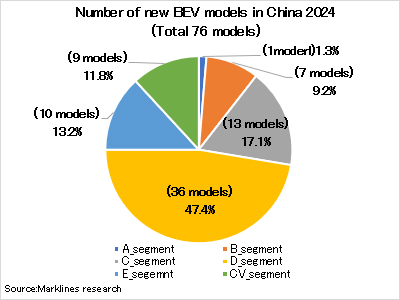

The pie chart below compares the number of new car models launched in 2023 and 2024. In Europe and the U.S., early adopter purchases of the main high-end/luxury models have leveled off, and it appears that sales expansion targets are beginning to shift to the B and C segments.

|

|

|

|

On the other hand, in China, luxury models are still thought to be driving the overall market.

|

|

If you register as a free member, you can read the rest of this article for a limited time.

In addition, you can also enjoy the following content for free:

AI Navigator

AI Navigator

Japan

Japan USA

USA Mexico

Mexico Germany

Germany China (Shanghai)

China (Shanghai) Thailand

Thailand India

India