Gestamp Automocion S.A. Business Report FY ended Dec. 2016

Financial Overview |

(in million EUR) |

| FY ended Dec. 31, 2016 | FY ended Dec. 31, 2015 | Rate of change (%) | Factors | |

| Net Sales | 7,548.9 | 7,034.5 | 7.3 | 1) |

| EBITDA | 841.1 | 760.3 | 10.6 | 2) |

| Sales by business unit | ||||

| Body-in-White and Chassis | 6,067.4 | 5,813.0 | 4.4 | 3) |

| Mechanisms | 902.4 | 832.1 | 8.4 | 4) |

Factors

1) Net Sales

-The Company’s net sales in the fiscal year ended December 31, 2016 increased by 7.3% over the previous year to EUR 7,548.9 million. Excluding currency effects, the Company’s sales increased by 12.3% over the previous year. The increase in sales was due to improved sales in North America, Europe and Asia. The gains in those regions were partially offset by a decrease in revenue in South America, due to a weaker Brazilian market.

2) EBITDA

-The Company had an EBITDA of EUR 841.1 million in the fiscal year ended December 31, 2016, an increase of 10.6% over the previous year. Sales growth in North America, Asia and Europe contributed to the increase in earnings, while a decline in South America and negative currency effects partially offset those increases.

3) Body-in-White and Chassis

-Sales in the combined Body-in-White and Chassis business units totaled EUR 6,067.4 million in the fiscal year ended December 31, 2016, an increase of 4.4% over the previous year. The Company received a number of projects in which it was the only source for nearly all of the vehicle’s Body-in-White stampings, thus increasing its revenue. Sales increased in all of the Company’s operating regions except for South America.

4) Mechanisms

-In the fiscal year ended December 31, 2016, the Mechanisms business unit had sales of EUR 902.4 million, an increase of 8.4% over the previous year. Sales in the business unit increased in all regions, with the biggest increase occurring in Asia.

Acquisitions

-On November 24, 2016, the Company’s subsidiary, Gestamp Metalbages, acquired 60% of the share capital of ESSA Palau for EUR 23.4 million. As a result of the transaction, ESSA Palau became a wholly owned subsidiary of Gestamp Metalbages. ESSA Palau is based in Barcelona, Spain, and stamps and manufactures components for passenger cars.

Restructuring

-Mitsui & Co., Ltd. has agreed to purchase the Company’s shares. Mitsui will invest EUR 416 million (approximately JPY 47 billion) in the Company, through which Mitsui will indirectly own 12.525% of the Company via Gestamp 2020, SL. Gestamp 2020 is a special purpose company established between ACEK Desarrollo y Gestion Industrial, S.L., a holding company of the founding family of the Company, and Mitsui. The amount of investment from Mitsui will be adjusted based on the Company’s coming financial results. The transaction is expected to be carried out by March 2017. Upon the transaction’s completion, Gestamp 2020 will own 50.1% of the Company, and ACEK and others will decrease the percentage of their shareholding in the Company from the current 100.0% to 49.9%. Mitsui has been strengthening its relationship with the Company since it started investing in the Company’s operations in the Americas in 2013. This investment will allow Mitsui to capture the needs of automotive manufacturers in the Americas and across a global scale, and enable Mitsui to seize the growth of the high performance material market. (From a press release on September 8, 2016)

-The Company announced that ArcelorMittal has sold its 35% stake in the Company to the majority shareholder, the Riberas family, for a total cash consideration of EUR 875 million. ArcelorMittal entered into a joint venture with the Riberas family in 1998. After the transaction, ArcelorMittal will continue to have a board presence in the Company, collaborate with the Company in automotive R&D and remain as its major steel supplier. (From a press release on February 5, 2016)

Contracts

-The Company currently manufactures various bodywork components for the 2016 Honda Civic in its plant in West Virginia, U.S. The Company and Honda co-developed the soft zone system for the Honda Civic. This co-development started in 2013 with Honda in Japan, and then shifted to North America in 2014. (From a press release on May 11, 2016)

Awards

-The Company received the Volkswagen Group Award 2016 as one of the automaker’s best suppliers. (From a press release on June 2, 2016)

-The Company received a 2015 Supplier of the Year award from General Motors. (From a press release on March 10, 2016)

R&D Expenditure |

(in million EUR) |

| FY ended Dec. 31, 2016 | FY ended Dec. 31, 2015 | FY ended Dec. 31, 2014 | |

| Overall | 298.5 | 240.9 | 180.1 |

-The Company announced that it has received EUR 160 million from the European Investment Bank (EIB) for financing research and innovation. The Company will be able to use the funding to invest in research and development at its factories in Spain, Germany, France, Sweden and the UK. The Company’s home market of Spain will receive investment totaling EUR 41.6 million, i.e. 26% of the total. The Investment Plan for Europe will allow the Company to implement a new four-year research program at its European sites to produce key components for making cars safer and cleaner. (From a press release on July 14, 2016)

R&D Structure

-The Company has a total of 12 research and development facilities and approximately 1,300 employees working on research and development activities.

R&D Facilities

-As of March 1, 2017, the Company has 12 research and development centers located in the following eight countries along with an additional research and development center under construction in Asia:

- Spain

- Germany

- France

- Sweden

- U.S.

- Brazil

- China

- Japan

R&D Activities

-The Company’s research and development efforts for body-in-white products primarily involve collaboration with OEMs to improve vehicle characteristics such as passive safety, NVH, architecture, crash performance, deformation monitoring and energy absorption.

-In the Chassis business unit, the Company focuses its research and development efforts on improving qualities such as stiffness, strength, durability, and crash effects while also considering themes of weight reduction and cost savings.

-In the Company’s Mechanisms business unit, research and development focuses on weight reduction, ease of use and safety.

Product Development

Products shown at IZB trade fair

-The Company displayed a variety of products and technologies at the IZB suppliers’ trade fair:

- Battery box prototype for electric vehicles: The prototype was developed in collaboration with Volkswagen and consists of modules that support the battery cells. If a cell fails, the design of the box enables the module to be changed in a faster and safer manner, by avoiding contact with the cells. The prototype is also scalable, thus allowing it to be used in a variety of vehicle models.

- Front lower control arm: The control arm features an integrated ball joint. The ball joint is integrated with a plastic overmolding process, which reduces the weight of the component and enables greater precision in the components characteristics. Additionally, the ball joint is directly integrated into the welded assembly, without the use of additional components.

- Aluminum door with electric opening: Edscha presented an aluminum door that utilizes electric opening mechanisms, with hinges that are made from high-strength aluminum.

- Stopped door: Edscha presented a door which combines a doorstop with various sensors to detect objects in the door’s path, and prevents the door from colliding with various obstacles.

- Soft-zone hot stamping technology: The Company has developed a hot stamping process in which different attributes can be integrated into a single part. The method is suited to create lighter structures with controlled deformation in electric vehicles to compensate for increased battery weight.

-The Company was nominated as a strategic partner for Volkswagen’s “Future Automotive Supply Tracks” initiative for its expertise in skin panels. (From a press release on May 23, 2016)

Patents

-As of December 31, 2016, the Company held more than 960 patents, utility models and applications related to its business and products.

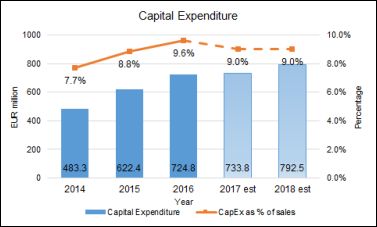

Capital Expenditure |

(in million EUR) |

| FY ended Dec. 31, 2016 | FY ended Dec. 31, 2015 | FY ended Dec. 31, 2014 | |

| Total | 724.8 | 622.4 | 483.3 |

-A key aspect to the Company’s growth is its capital expenditure, as it is used primarily to construct new manufacturing plants or to increase production capacity in existing plants. The Company expects that its capital expenditure as a percentage of net sales for the fiscal years ending December 31, 2017 and 2018 to be similar to the capital expenditure percentage average from 2013 through 2016. Assuming net sales growth of approximately 8% per year in future years, as well as a capital expenditure totaling 9% of total net sales, the Company’s capital expenditure is estimated to be approximately EUR 800 million in the fiscal year ending December 31, 2018.

-A key aspect to the Company’s growth is its capital expenditure, as it is used primarily to construct new manufacturing plants or to increase production capacity in existing plants. The Company expects that its capital expenditure as a percentage of net sales for the fiscal years ending December 31, 2017 and 2018 to be similar to the capital expenditure percentage average from 2013 through 2016. Assuming net sales growth of approximately 8% per year in future years, as well as a capital expenditure totaling 9% of total net sales, the Company’s capital expenditure is estimated to be approximately EUR 800 million in the fiscal year ending December 31, 2018.

-Most of the Company’s capital expenditures have been dedicated towards increasing the production capacities at various production facilities due to an increase in orders from the Company’s customers.

-The Company invested EUR 1,830.5 in capital expenditures from 2014 through 2016. Of the capital expenditure during the three-year period, approximately EUR 850 million was invested towards growth projects. Of the EUR 850 million, approximately 52% was used for greenfield projects, 31% was used for major plant expansions, and 17% was used for new processes and technologies in existing plants.

-As of March 1, 2017, the Company has ten additional production facilities under construction. In addition, the Company expects to have 13 new manufacturing facilities and 10 plant expansions fully operations by 2019.

Investments outside Spain

-The Company chose to locate a new manufacturing facility in Chelsea, Michigan, U.S. The new facility will contain a chassis assembly line, electronic coat paint line, and a remote laser welding 3-D technology line. The Company will invest USD 68 million into the new plant, which is expected to create 195 new jobs over the next four years. Additional support for the plant came from the Michigan Economic Development Corporation, the Ann Arbor SPARK organization and the City of Chelsea. (From a press release on October 25, 2016)

-The Company plans to build a new manufacturing facility in Four Ashes near Wolverhampton in the UK. The new plant will entail an investment of more than GBP 70 million, with the Company investing GBP 56.3 million for the construction of the new factory. The new West Midlands plant spans 50,000 square meters and is designed to safeguard the 800 jobs at the Company's Cannock plant by progressively relocating production to the facility. The plant is expected to provide improved service to local customers, including BMW, Honda, Jaguar Land Rover, Renault-Nissan and Toyota. Production is scheduled to begin before the end of 2017. Once completed, the annual turnover of the new West Midlands plant will surpass GBP 140 million. Part of the existing facilities in Cannock may be retained to accommodate future training and development requirements. The Company has already invested over GBP 180 million in its UK plants since 2011, including over GBP 30 million in the Cannock facility. (From a press release on September 6, 2016)

-Edscha AG, a subsidiary of the Company, has laid the cornerstone for its new plant in the city of San Luis Potosi, Mexico. The production line is expected to operational as early as December 2016. The first products will be door hinges, door checks, liftgate hinges and hood hinges. Local production of powered systems for the automatic opening and closing of rear lids and liftgates is planned in the future. During the first construction phase, the new Edscha plant will occupy approximately 3,800 square meters. Approximately 60 persons will be employed at Edscha in Mexico by the end of 2016. The plant is scheduled to expand, spanning 10,000 square meters and employing 300 workers in the future. (From a press release on June 22, 2016)

-The Company announced that its subsidiary, Edscha, has opened its fourth plant in Russia in Togliatti. Approximately 50 employees have started assembling and manufacturing door hinges, liftgate hinges and rear door hinges for the Russian market, with an expected total production of 2.5 million hinges in 2016. In the medium term, Edscha plans to employ more than 150 employees in Togliatti. The plant has a production area of approximately 5,000 square meters. An additional 6,000 square meters is available for future expansion. (From a press release on March 10, 2016)

Japan

Japan USA

USA Mexico

Mexico Germany

Germany China (Shanghai)

China (Shanghai) Thailand

Thailand India

India