Adient plc (Formerly Automotive seating business of Johnson Controls Inc.) Business Report FY ended Sep. 2016

Financial Overview |

(in million USD) |

| FY ended Sep. 30, 2016 | FY ended Sep. 30, 2015 | Rate of change (%) | Factors | |

| Net Sales | 16,837 | 20,071 | (16.1) | 1) |

| Net Income | (1,449) | 541 | - | 2) |

| Net Sales by Segment | ||||

| Seating Segment | 16,616 | 16,859 | (1.5) | 3) |

| Interior Segment | 221 | 3,212 | (93.1) | 4) |

Factors

1) Net Sales

-The Company’s sales in the fiscal year ended September 30, 2016 decreased by 16.1% to USD 16,837 million. The decrease in net sales was primarily caused by negative foreign currency translation and the completion of the Yanfeng Automotive Interiors joint venture on July 2015, contributing to decreases of USD 411 million and USD 2,954 million, respectively. Excluding these two factors, combined net sales increased by USD 131 million, due to growth in Asia and Europe.

2) Net Income

-In the fiscal year ended September 30, 2016, the Company experienced a net loss of USD 1,449 million, a decrease of USD 1,990 million from the previous year. Factors primarily contributing to the loss include a series of one-time charges from the separation of the Company from Johnson Controls.

3) Seating

-Net sales in the Company’s seating segment in the fiscal year ended September 30, 2016 totaled USD 16,616 million, a decrease of 1.5% from the previous year. Higher sales volumes added USD 270 million to the segment, though the gain was offset by unfavorable foreign currency translation effects of USD 402 million and net unfavorable pricing and commercial settlements of USD 130 million.

4) Interior

-The Company’s interior segment had net sales of USD 221 million in the fiscal year ended September 30, 2016, a decrease of USD 2,991 million. The decrease in sales was primarily caused by the completion of the Yanfeng Automotive Interiors joint venture, which contributed to a decrease of USD 2,954 million. Other factors included lower volumes by plant wind downs, net unfavorable pricing and commercial settlements, and unfavorable foreign currency effects.

Restructuring

Spin-off of Automotive Experience business

-In July 2015, Johnson Controls announced plans to pursue a tax-free spin-off of its Automotive Experience business. Its interior components operations were suffering from tight margins and numerous competitors, leading Johnson Controls to make investments in its core segments of buildings and energy storage.

Transfer of interior business to joint venture with Chinese supplier

-In July 2015, Johnson Controls announced the formal launch of Yanfeng Automotive Interiors, a joint venture between Yanfeng Automotive Trim Systems Co., Ltd, a wholly owned subsidiary of Huayu Automotive Systems Co., Ltd (HUAYU) and Johnson Controls. Yanfeng Automotive Interiors is the world's largest automotive interiors parts supplier. Johnson Controls, transferring its interior business to the new joint venture will have a 30% share of the company which will be headquartered in Shanghai. The new company will have revenues of USD 8.5 billion and an order backlog of USD 10 billion. Yanfeng Automotive Interiors will have more than 90 manufacturing, development, engineering and customer service locations. The product portfolio will include instrument panels and cockpit systems, door panels, floor consoles and overhead consoles. (From a press release on July 2, 2015)

Spin-off of automotive seating business as Adient

-On October 31, the Company announced its debut as an independent, publicly traded corporation known as Adient and the completion of its separation from Johnson Controls International. The company's shares begin trading on the New York Stock Exchange. The Company is one of the world's largest global automotive seating suppliers, supporting all major automakers in differentiating vehicles through superior quality, technology and performance. With 75,000 employees, the Company operates 230 manufacturing & assembly plants in 33 countries. In addition, the Company is well-positioned in the growing China market, where it has 17 seating joint ventures (JVs) operating 60 manufacturing locations in 32 cities. (From a press release on October 31, 2016)

Chinese Business

|

| Source: Adient |

-A key component in the Company’s growth strategy is its position of leadership in China. Based on production volumes, the Company is the largest supplier of just-in-time seating in China. As market leader, the Company has a 44% market share of the seating business in China.

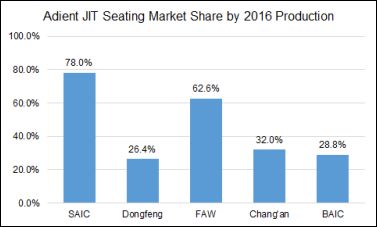

-The Company has formed joint ventures with all of the major Chinese automakers including SAIC, Dongfeng, FAW, Chang'an, BAIC, GAC and Brilliance Auto. These joint ventures have enabled the Company to hold significant market share with individual automakers.

-For the fiscal year ended in September 30, 2016, the Company’s operations in China, including joint ventures, earned USD 7.3 billion in revenue. Its operations include the following:

- 17 joint ventures

- 3 technology centers

- 1,300 engineers

- 60 manufacturing plants across 32 cities

- 31,000 employees

-The Company has a 29.7% stake in Yanfeng Automotive Interiors Systems Co., Ltd. The Company retained control of the stake from Johnson Controls upon completion of the spin-off.

Contracts

-The Company announced that it worked with Volvo for the seats of the 2017 Volvo S90. The seats use high-quality seat cover material and comfortable upholstery. In addition, the Company developed and integrated the Volvo S90's rear seating, including its metal structures. The Company was responsible for its entire development process, from designing and supplying the metal structure to integration. (From a press release on May 31, 2016)

Awards

-The Company received an Award for Excellence from Toyota Motor Corporation for its seats used in the 2016 Toyota Tacoma. (From a press release on March 16, 2016)

-The Company’s technology center in Ansan, Korea was recognized and awarded the “Technology 5 Star” certification from Hyundai-Kia. (From a press release on February 23, 2016)

-Chongqing Yanfeng Johnson Controls Automotive Components Co., Ltd. (CQYFJC), one of the Company's major automotive seating joint ventures in China, has been honored with Volvo Cars Quality Excellence Award. CQYFJC's new Chengdu plant was recognized for its outstanding quality performance delivered in Volvo S60L and Volvo XC60 Seating projects. (From a press release on November 2, 2015)

Outlook

-The Company announced that it has set a revenue target of USD 16.8 to USD 17 billion for the fiscal year ending September 30, 2017. The Company also unveiled its intention to maintain its industry leading position in China's automotive seating market. The Company has 17 seating joint ventures in China operating 60 manufacturing locations in 32 cities. (From a press release on September 15, 2016)

R&D Expenditures |

(in million USD) |

| FY ended Sep. 30, 2016 | FY ended Sep. 30, 2015 | FY ended Sep. 30, 2014 | |

| Total | 460 | 599 | 667 |

R&D Facilities

-The Company has expanded its test capabilities in Burscheid, Germany, with a new hydraulic high-frequency vibration test system known as a “shaker.” The automotive supplier is investing approximately EUR two million in the test system. Equipped across six axes, this system enables comprehensive comfort and durability tests over a driving distance of 100,000 km (approximately 62,140 miles). Installation in a special climate chamber allows the simulation of different climatic conditions. (From a press release on November 9, 2015)

-The Company has 12 core engineering development centers in the following locations:

- Plymouth, Michigan, U.S.

- Burscheid, Germany

- Kaiserslautern, Germany

- Remscheid, Germany

- Solingen, Germany

- Trencin, Slovakia

- Shanghai, China

- Changchun, China

- Chongqing, China

- Yokohama, Japan

- Ansan, Korea

- Pune, India

Product Development

Reduced-emissions polyurethane foam

-The Company is bringing the third generation of its reduced-emissions polyurethane foam to market. Depending on the specification, the foam registers up to 90% fewer volatile organic compounds than ten years ago. The Company also has significantly reduced the quantity of material impurities and their associated odors in the foam. The Company's Technical Center in Strasbourg, France is leading research into low-emission foam development. Cooperating with the Company's research and development centers in Plymouth, Michigan, U.S., and Shanghai, China, the Strasbourg team creates solutions for the global market that significantly exceed the strict emission requirements of global OEMs. Production of the latest low-emission foam takes place at the Company's facilities in Europe and China. A third location in the U.S. is planned. (From a press release on March 3, 2016)

Capital Expenditure |

(in million USD) |

| FY ended Sep. 30, 2016 | FY ended Sep. 30, 2015 | FY ended Sep. 30, 2014 | |

| Total | 437 | 478 | 624 |

Japan

Japan USA

USA Mexico

Mexico Germany

Germany China (Shanghai)

China (Shanghai) Thailand

Thailand India

India