Search Results by Category

AI Navigator

AI NavigatorAll information related to {{ key_word }}.

AI Navigation will guide you. Click here for information about {{ key_word }}.

3

3

1

1

2

2

2

2

2

2

2

2

2

2

4

4

3

3

3

3

1 - 20 of 210 results

JTEKT India Limited (Formerly Sona Koyo Steering Systems Ltd.)

facility will be constructed in north India. The facility is expected to launch in 2008 with the production of light vehicle axles for Tata Motors. (From a press release on Oct. 30, 2007) JTEKT Corp. has received orders from Tata Motors Ltd., India, for the manual steering of the Nano, an ultra-low priced car to be launched in India this year. Sona Koyo Steering Systems Ltd., its joint venture in Haryana, Gurgaon, India will produce the product. ...

Major Suppliers Updated at: 2025/12/25

Anand Automotive Private Limited (Formerly Anand Automotive Limited)

nd door balancers for passenger and commercial vehicles. Based on Gabriel India Limited stock exchange notification SAF-HOLLAND SE has acquired the remaining 40% stake in its Indian joint venture, Haldex ANAND India Pvt. Ltd. (Haldex India), from ANAND Group, effective April 11, 2025. The purchase price was in the lower double-digit million-euro range. Founded in 1996, Haldex India became part of SAF-HOLLAND with 60% of the shares following the ...

Major Suppliers Updated at: 2025/12/25

UNO Minda Ltd. (Formerly Minda Industries Ltd.)

pan. Minda’s Board also approved the merger of its Subsidiary and JV, namely Minda TG Rubber Private Limited (MTG) wlth Toyoda Gosei Minda. The company will sale out/ transfer its 555,753 equity shares held in Minda TG Rubber to the JV partner Toyoda Gosei Co. Ltd., Japan, before the merger, at a price determined by the independent valuer for an aggregate value of INR 5.6 million. (Minda Industries Limited stock exchange filing on November 10, ...

Major Suppliers Updated at: 2025/12/25

GS Yuasa International Ltd.

. With its large output and superior energy recovery, applications in electric bicycles, electric tools and energy recovery batteries requiring high output are anticipated in addition to hybrid vehicles. (From an article in the Nikkan Jidosha Shimbun on Feb. 03, 2007) GS Yuasa Power Supply to raise price of industrial lead batteries in April GS Yuasa Power Supply Ltd. announced 10% shipping price increase of industrial lead batteries and industri...

Major Suppliers Updated at: 2025/12/17

Pacific Industrial Co., Ltd.

rman of Pacific Industrial, for the purpose of delisting the target shares. The move is intended to allow the company to focus on its mid- to long-term strategies, such as upfront investments related to electrification. The total purchase amount is expected to be JPY 113.1 billion. The tender offer price is JPY 2,050 per share, exceeding the closing price of JPY 1,461 as of July 24. The TOB period runs from July 28 to September 8. The shares owne...

Major Suppliers Updated at: 2025/12/17

TACHI-S Co., Ltd.

manufacturers. (From an article in the Nikkan Jidosha Shimbun on March 8, 2011) Tachi-S Co., Ltd. is set to develop a new cost efficient seat frame for global compact cars based on the low cost seat structure on minivehicles. A simple, basic function, low cost frame will be made a benchmark for low price vehicles in the global market. Tachi-S is seeking economies of scale by increasing the number of common parts used in the seat frame in response...

Major Suppliers Updated at: 2025/12/17

Aichi Steel Corporation

cles for automotive motor applications Aichi Steel to increase production of forged products other than crankshafts in the U.S. Aichi Steel to supply magnetic marker position estimation technology to East Japan Railway Aichi Steel Corporation's third quarter results (cumulative) Aichi Steel raises prices of specialty and stainless steels Aichi Steel to increase stainless steel supply capacity by 40% to 90,000 tons by FY 2026 Aichi Steel introduc...

Major Suppliers Updated at: 2025/12/17

Kasai Kogyo Co., Ltd.

pany to reform its structure. After considering various possibilities, Kasai Kogyo decided to transfer all of its shares in KGE and it has reached a point where it is ready to transfer its shares. The shares will be transferred to Callista Asset Management 29 GmbH on March 31, 2025. The transaction price is not disclosed. (From a press release dated March 19, 2025) R&D Expenditure (in million JPY) FY endedMar. 31, 2025 FY ended...

Major Suppliers Updated at: 2025/12/16

Bosch (Bosch Corporation)

systems outside Germany. (From an article in the Nikkan Jidosha Shimbun on June. 16, 2010) Hideaki Oda, President and CEO of Bosch Corporation (Japan), disclosed the mid-term business strategy at a press meeting held in Tokyo on May 27. By increasing expertise shared in designing components for low-priced vehicles among the group companies, including a subsidiary in India, which has experienced development of low cost products, Bosch will endeavo...

Major Suppliers Updated at: 2025/12/16

Kojima Industries Corporation

Kojima Industries Corporation. Kodama Chemical will inject new capital in EATI to strengthen management setup and prepare for future enhancement of production capacity. Kodama Chemical is planning to sell 2,500 shares in EATI, which is about one-third of the 7,260 shares it currently owns. The sale price is IDR 1 (approximately JPY 0.008) per share. (From an article in the Nikkan Jidosha Shimbun on November 24, 2016) Uchihama Kasei Corp. (Uchiham...

Major Suppliers Updated at: 2025/12/16

Nippon Piston Ring Co., Ltd.

3th Automotive World 2021 event, which ended on January 22, CASE (connected, autonomous, shared, and electric)-related exhibitions had a strong presence. Macnica, Inc. (Kita Ward, Yokohama City) exhibited France-based Navya’s EVO autonomous bus. Cepton Technologies Inc. exhibited proximity LiDARs priced at less than USD 100. Murata Manufacturing Co., Ltd. displayed a “raindrop removal device” that protects an automotive camera lens under de...

Major Suppliers Updated at: 2025/12/16

PT. Astra Otoparts Tbk

(From a press release on April 19, 2011) PT. Astra Otoparts officially divested all of its stocks or 5% of the company's stocks owned by the Company in PT. EDS Manufacturing Indonesia to YIC Asia Pacific Corporation Ltd which is based in Thailand. The total stocks sold were 360 stocks with a total price of approximately 3.6 million USD. (From a press release on May 2, 2012) PT. Astra Otoparts Tbk signed an agreement with Juoku Technology of Taiw...

Major Suppliers Updated at: 2025/12/15

PIOLAX, INC.

n/close mechanisms for mini vehicles Piolax to tie-up with A. Raymond for fastening products Piolax to boost production capacity for automotive metal parts in U.S. Nissan-affiliated parts suppliers to expand new customers other than Nissan Piolax to build 2nd plant in India to start delivering high-priced four-wheel vehicle parts in 2026 Piolax revises mid-term business plan downward Piolax to establish factory dedicated to producing EV and ADAS ...

Major Suppliers Updated at: 2025/12/15

Motherson Yachiyo Automotive Systems Co., Ltd. (Formerly Yachiyo Industry Co., Ltd.)

ect on its own and does not plan to request Honda for capital increase. (From an article in the Nikkan Jidosha Shimbun on Jul.20, 2007) Yachiyo Industry announced its planned sale of Honda Motor Co., Ltd. shares it owns. Yachiyo will dispose a total of 1,614,900 Honda Motor shares at the aggregated price of 6,680,841,000 yen. The transaction will result in a one-time earnings gain of 5,789,157,000 yen which will be reflected on the consolidated f...

Major Suppliers Updated at: 2025/12/11

Faurecia Clarion Electronics Co., Ltd.

d ECUs for automatic parking systems to Nissan Motor Co., Ltd. Mar. 2019 Became a wholly owned subsidiary of Faurecia. Jan. 2021 Changed the current name to "Faurecia Clarion Electronics". Clarion to tackle emergency structural reforms Clarion and Xanavi jointly developing lower-priced car navigation device, targeting production launch in FY2010 Clarion to offer 2009 spring models of car navigation systems corresponding to pro...

Major Suppliers Updated at: 2025/12/10

Murakami Corporation

potlight on gesture control in next-generation automotive interiors Murakami Corporation to construct new rear-view mirror plant in Tianjin City, China Murakami wins orders for Hybrid Inner Mirror Osram's LED module first chosen by Japanese automaker for fog lamps Murakami Corp. to propose low price antidazzle mirror against discharge headlamps Murakami to acquire Oshima Electric Works from Mitsuba to make it a subsidiary Murakami’s subs...

Major Suppliers Updated at: 2025/12/05

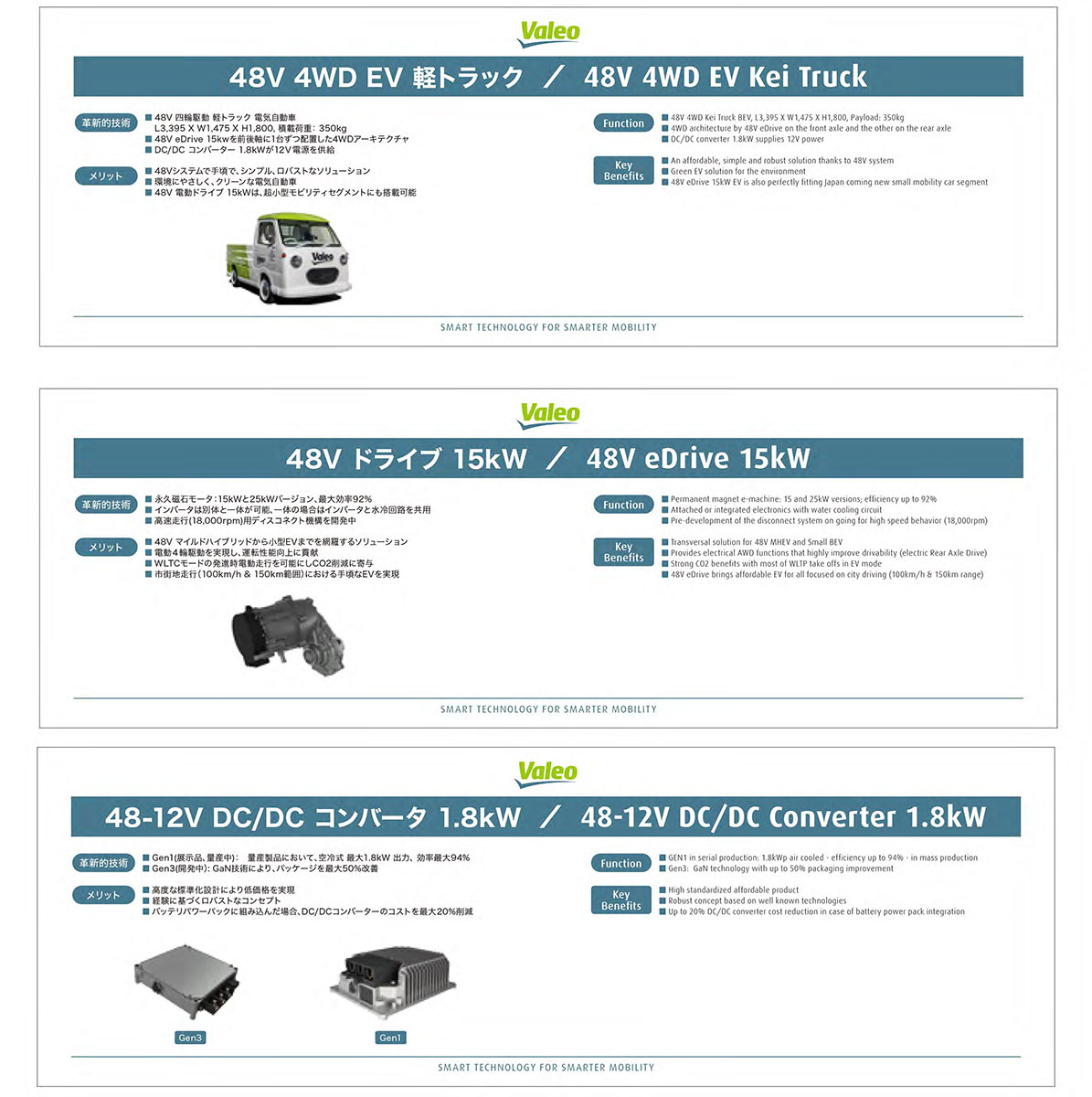

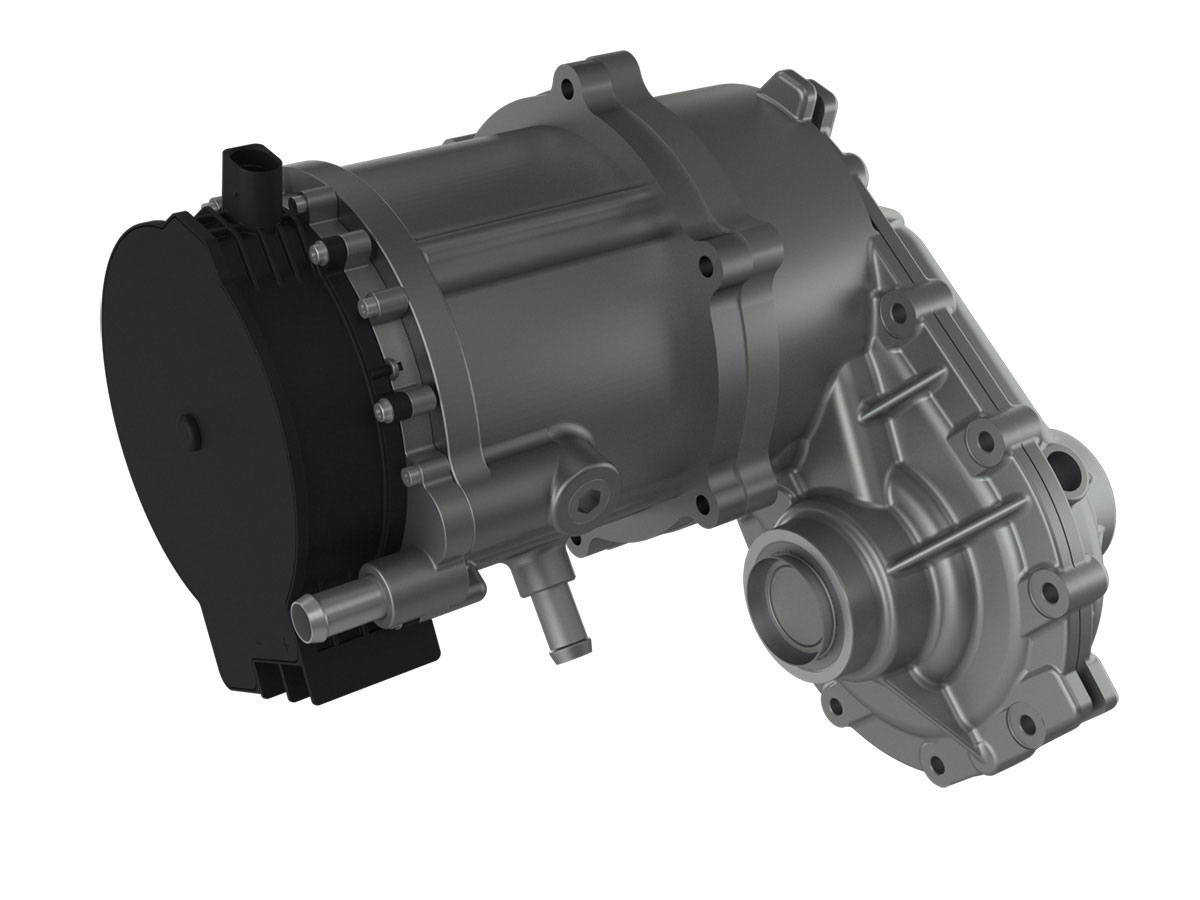

Valeo Group

Valeo to acquire Germany-based air conditioning system supplier Spheros Valeo Japan sets up testing area for autonomous driving technologies Valeo unveils its latest autonomous driving technologies at CES 2016 Guangzhou Valeo Engine Cooling inaugurates Wuhan Plant Valeo develops new, competitively priced ADAS sensor Valeo to commercialize electronic mirrors in 2018 Valeo to acquire German clutch manufacturer FTE automotive Ichikoh Industries se...

Major Suppliers Updated at: 2025/12/05

U-SHIN LTD.

k into starting production in Europe as well. (From an article in the Nikkan Jidosha Shimbun on June 13, 2018) MinebeaMitsumi Inc. announced that it plans to acquire shares of common stock in U-shin Ltd. (U-shin) in late January 2019 to make the company its consolidated subsidiary. The tender offer price will be about JPY 32.6 billion. Through the acquisition of U-shin, a tier-1 automotive parts supplier, MinebeaMitsumi aims to boost its presence...

Major Suppliers Updated at: 2025/12/05

Press Kogyo Co., Ltd.

or truck frames with great durability is particularly strong in emerging countries due to overloading on rough roads. Press Kogyo is poised to meet such demand by increasing the use of high-strength materials such as high-tensile steel and taking advantage of its leading technologies to manufacture price-competitive products with high processing accuracy. Through these measures, the company intends to differentiate its products from those of truc...

Major Suppliers Updated at: 2025/12/04

UNIPRES Corporation

d Nippon Steel & Sumitomo Metal Corporation (NSSMC) announced an expansion of their capital and business alliance, under which NSSMC will acquire an additional 2.65 million shares in Unipres. Unipres plans to dispose of the shares through a third party allotment effective May 29, 2015. The purchase price will be approximately JPY 6.56 billion (USD 54.9 million). As a result of this acquisition, NSSMC will raise the percentage of its shareholding ...

Major Suppliers Updated at: 2025/12/04

AI Navigator

AI Navigator

Japan

Japan USA

USA Mexico

Mexico Germany

Germany China (Shanghai)

China (Shanghai) Thailand

Thailand India

India