Press Release

July 1, 2015

Sales Ranking of Top 30 Suppliers in FY 2014

MarkLines Co., Ltd.

- ・MarkLines Co., Ltd. (President and CEO: Makoto Sakai) has compiled a list of the 30 leading suppliers based on sales to the automotive industry for the fiscal year 2014 (U.S. dollar equivalent, including estimates).

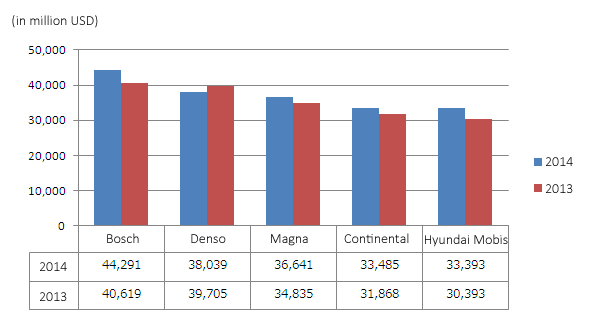

- ・The top five suppliers on the list are Bosch, Denso, Magna, Continental and Hyundai Mobis. The order remained unchanged from the previous year. All five suppliers recorded steady sales gains in North America, Europe and Asia, with roughly a 5% or more increase from fiscal year 2013. However, Japanese suppliers suffered a year-on-year decline in sales in the U.S. dollar equivalent due to the rapid weakening of the yen. Excluding the effects of foreign exchange rates, Denso recorded a 5.0% year-on-year increase while Aisin Seiki, which ranked sixth on the list, posted a 5.4% increase.

- ・Each company is enhancing the development of electrical systems and Advanced Driver Assistance Systems (ADAS) as new growth sectors. Bosch opened its new Bosch Center for Research and Advance Engineering in Germany in October 2014 in line with its development strategy to focus on electrical systems, connectivity and autonomous driving. Denso has unveiled a preventive safety system combining a millimeter wave radar and a camera. In recent exhibitions, Bosch and Continental displayed 48V mild hybrid systems and radar sensors compatible with ADAS and cameras. Magna and Valeo have showcased electric superchargers. Japanese suppliers are expanding the lineup of parts for fuel-cell vehicles and hybrid cars.

- ・On another front, mega suppliers have increased their business restructuring activities. In May 2015, ZF completed the acquisition of TRW Automotive, making ZF the second largest supplier based on the sum of the two companies' 2014 sales. Other examples include the sale of Delphi's thermal (air conditioning) systems business to Mahle, and Visteon's sale of its climate control business to Hankook Tire. Meanwhile, Johnson Controls sold its automotive electronics business to Visteon in July 2014, and announced in June 2015 that it was considering the divestiture of its automotive business. Furthermore, in June 2015 Bosch announced that it would consider the sale of its starter motor and generator business.

Supplier Sales Ranking for FY 2014

(Sales to the automotive industry)

| (Note): | If you register as a free member, you will have access to all MarkLines' content free of charge for 24 hours. For free member registration, please click here. |

| For inquiries on corporate member registration and website usage, please contact: MarkLines Customer Support Tel: +81-3-5785-1387 (9:00-17:30 (JST) Mon.-Fri. [except national holidays]) E-mail: support@marklines.com |

Supplier Sales Ranking for FY 2014

(in million USD)

| Rank | Supplier | Sales to automotive industry |

Y/Y change* | Factors | ||

|---|---|---|---|---|---|---|

| FY 2014 |

FY 2013 |

FY 2014 |

FY 2013 |

|||

| 1 | 1 | Robert Bosch | 44,291 | 40,619 | 9.0% | -Enjoyed strong sales in the Asia-Pacific region (up 17% year-on-year (y/y)) and North America (up 8.6% y/y) -Greater demand for gasoline direct injection systems and injectors compliant with the Euro 6 and China IV emission standards |

| 2 | 2 | Denso | 38,039 | 39,705 | (4.2%) | -Though sales in Japan declined 2.0% y/y, the company recorded a double-digit growth in North America, Europe and the Asia and Oceania region (including China) -Sales in FY 2014 increased 5.0% from FY 2013 (using the exchange rate for FY 2013) |

| 3 | 3 | Magna International | 36,641 | 34,835 | 5.2% | -Recorded a y/y increase of 17.9% in Asia: sales steadily grew in North America as well -Acquired Techform Group of Companies, a U.S.-based closure products manufacturer |

| 4 | 4 | Continental | 33,485 | 31,868 | 5.1% | -Achieved a sharp increase in sales mainly in NAFTA and China -Acquired two manufacturing bases of Mecaseat Group, a Belgian seat surface maker; Veyance Technologies, a U.S.-based rubber and plastic products maker; and Emitec, a supplier of exhaust aftertreatment systems |

| 5 | 5 | Hyundai Mobis | 33,393 | 30,393 | 9.9% | -Sales in the Americas, Europe and China remained strong. -Sales in FY 2014 increased 5.7% from FY 2013 (using the exchange rate for FY 2013) |

| 6 | 6 | Aisin Seiki | 26,048 | 27,087 | (3.8%) | -Yen-based revenue expanded due to an increase of total output of its customer carmakers -Sales in FY 2014 increased 5.4% from FY 2013 (using the exchange rate for FY 2013) |

| 7 | 7 | Faurecia | 25,030 | 23,941 | 4.5% | -Sales increased from the previous year in all of its business segments. Exterior parts business posted a 8.6% increase y/y. -Sales to BMW fell 12.8% y/y and those to FCA Group excluding Fiat also declined 9.9% y/y. However, sales to its major customers such as VW, Ford and PSA remained strong |

| 8 | 8 | Johnson Controls | 23,756 | 22,051 | 7.7% | -Automotive business posted a y/y increase in sales of 7.7%, thanks to a growth in the seat and interior parts segment -Battery business recorded a 4.3% y/y increase, which is attributable to a boost in sales volume and a corporate acquisition |

| 9 | 9 | ZF Friedrichshafen | 21,542 | 19,676 | 9.5% | -Sales of ATs and axle systems for passenger cars showed a sharp increase in North America and China to record highs in both regions -The company acquired TRW in May 2015. The sum of the two companies’ sales in FY 2014 makes ZF the second largest supplier in terms of sales |

| 10 | 12 | Lear Corporation | 17,727 | 16,234 | 9.2% | -The seat business reported a 10.8% rise in sales from a year ago -Plans to expand business by acquiring Eagle Ottawa, a leather maker for automotive interiors, by the end of 2015 -Electric systems division posted a 4.8% increase of sales from FY 2013 |

| 11 | 10 | TRW Automotive | 17,539 | 17,435 | 0.6% | -Despite a double-digit sales growth of its electronic components business, total sales increased just by 0.6% y/y due to the sale of its brake parts and module business in North America -ZF completed acquisition process of TRW in May 2015 |

| 12 | 11 | Delphi Automotive | 17,023 | 16,463 | 3.4% | -Achieved a 3.4% increase of sales y/y, attributable to the strong business performance in North America and the Asia-Pacific region -Acquired Unwired Technology, a media connectivity products manufacturer, and Antaya Technologies, a connector maker for glass in the U.S., to reinforce its connectivity business -Planning to sell its thermal systems business to Mahle in 3Q 2015 |

| 13 | 13 | Valeo | 16,408 | 15,487 | 6.0% | -Valeo Sylvania, which had been a joint venture with Osram, became a wholly owned subsidiary and contributed to the sales growth -While sales in South America plummeted by 26.8%, the company enjoyed strong performance in China (up 30.1% y/y) and North America (up 27.0% y/y) |

| 14 | 14 | Sumitomo Electric Industries | 13,540 | 13,479 | 0.5% | -Automotive business sales, including Sumitomo Wiring Systems and other group companies, grew 10.2% y/y (yen-based), mainly due to robust demand for wire harnesses outside Japan, specifically in the U.S. |

| 15 | 15 | Yazaki | 13,243 | 13,402 | (1.2%) | -New orders received combined with the recovery of the North American market and a weaker yen pushed up automotive business sales by 13.9% (estimate, yen-based) |

| 16 | 16 | ThyssenKrupp | 12,893 | 12,522 | 3.0% | -The recovery in the automotive sector in Western Europe, China and NAFTA boosted its revenues |

| 17 | 20 | Schaeffler | 11,942 | 10,841 | 10.1% | -Localization of production and business operation in China led to a 34.4% sales growth in the country. -It recorded an increase in revenues in other markets as well: 7.0% in the Asia-Pacific region, 6.9% in Europe and 8.0% in the Americas -A double-digit growth was reported by the engine system business (up 11.4% y/y) and the transmission business (up 15.2% y/y) |

| 18 | 21 | HUAYU Automotive Systems | 11,455 | 10,781 | 6.2% | -The company oversees automotive parts business under the umbrella of SAIC -Acquired remaining 50% stake in Yenfeng Visteon Automotive Trim Systems, formerly a 50-50 joint venture with Visteon, making it a wholly owned subsidiary -Acquired a 50% stake in KS Aluminium-Technologie GmbH from KSPG -Yanfeng Automotive Trim Systems, its subsidiary, will establish a joint venture for interior parts business with Johnson Controls in 2015 |

| 19 | 17 | Panasonic (Automotive & Industrial Systems Company) |

11,408 | 11,752 | (2.9%) | -Its automotive business (having a 45% share in the company’s overall sales) recorded brisk sales mainly in North America and Europe -Recently established a lithium-ion battery cells manufacturing subsidiary in Tesla’s Gigafactory -Formed a capital tie-up with Ficosa of Spain -Sales in FY 2014 increased 6.4% from FY 2013 (using the exchange rate for FY 2013) |

| 20 | 18 | Toyota Boshoku | 11,300 | 11,555 | (2.2%) | -Recorded double-digit growth y/y in the Americas and Europe/Africa: 34.2% and 17.9%, respectively. -Its seat frame mechanism parts business will be transferred to the company from Aisin Seiki and Shiroki Corporation in November 2015. -Sales in FY 2014 increased 7.1% from FY 2013 (using the exchange rate for FY 2013) |

| 21 | 28 | Mahle | 11,079 | 7,946 | 39.4% | -Sales growth can be attributed to the inclusion of full-year consolidated financial performances of the former Behr Group and Lertika Group, which were acquired by Mahle -Plans to acquire Delphi's thermal business by the end of 2015 to reinforce the thermal business, which generates approximately 30% of the company's total sales |

| 22 | 19 | JTEKT | 10,912 | 11,177 | (2.4%) | -Recorded a 7.0% growth in revenue from the previous year thanks to a steep rise in the sales of steering products -Sales in FY 2014 increased 7.0% from FY 2013 (using the exchange rate for FY 2013) |

| 23 | 22 | Toyota Industries | 9,573 | 10,050 | (4.7%) | -Its automotive air conditioner compressor business, which recorded robust sales in North America and China, posted a 18% y/y increase -Divisions for electronic devices and cast components also recorded a double-digit growth of 22% -Automotive division’s sales reached a record high based on yen -The company announced in December 2014 that the development and production of diesel engines will be transferred from Toyota Motor Corporation to the company -Sales in FY 2014 increased 4.4% from FY 2013 (using the exchange rate for FY 2013) |

| 24 | 24 | Autoliv | 9,241 | 8,803 | 5.0% | -Demand for all product groups in the active safety division grew sharply by 41.7% from the previous year -As of fiscal year ended December 2014, the company holds approximately a 40% global market share for seat belts and airbags |

| 25 | 23 | Calsonic Kansei | 8,797 | 9,172 | (4.1%) | -Suffered a 9.1% decline in revenues from a year ago in Japan, but achieved a double-digit growth in the Americas (up 21.8%) and Europe (up 17.6%) -Sales in FY 2014 increased 5.1% from FY 2013 (using the exchange rate for FY 2013) |

| 26 | 27 | Magneti Marelli | 8,641 | 7,952 | 8.7% | -Achieved an increase in revenue as its North American, Chinese and European divisions performed well |

| 27 | 26 | Tenneco | 8,420 | 7,964 | 5.7% | -Enjoyed strong sales of exhaust systems in Europe, China and Japan, and suspension systems for commercial vehicles in North America |

| 28 | 31 | Gestamp Automocion | 8,316 | 7,772 | 7.0% | -Revenue increased from a year ago in China, North America and Western Europe |

| 29 | 30 | Weichai Power Co., Ltd. | 7,937 | 7,800 | 1.8% | -The company holds the second largest share in the Chinese market for automotive diesel engines |

| 30 | 29 | Benteler International | 7,797 | 7,839 | (0.5%) | -The company's business performance was negatively impacted by the weak Brazilian market, the closure of a production plant and the disposal of business during 2014, despite strong sales in Europe, U.S. and Asia |

*A figure in brackets ( ) indicates a loss

Notes

Explanation of derivations for the figures used in the ranking

| Supplier | Fiscal year end | Derivations of sales figures | |

|---|---|---|---|

| FY2014 | FY2013 | ||

| Robert Bosch | Dec. 2014 | Sales of Mobility Solutions division | Sales of Mobility Solutions division |

| Denso | Mar. 2015 | Automotive related sales including powertrain devices, heat devices, information and safety devices, electronic devices, motors and air conditioning devices | Automotive related sales including powertrain devices, heat devices, information and safety devices, electronic devices, motors and air conditioning devices |

| Magna International | Dec. 2014 | Total sales including Complete vehicle assembly segment and Tooling, engineering and other segment | Total sales including Complete vehicle assembly segment and Tooling, engineering and other segment |

| Continental | Dec. 2014 | Sales from automotive manufacturers (approximately 73%) | Sales from automotive manufacturers (approximately 72%) |

| Hyundai Mobis | Dec. 2014 | Total sales excluding Finance division | Total sales excluding Finance division |

| Aisin Seiki | Mar. 2015 | Total sales excluding the product category of Life & Amenity related and Others | Total sales excluding the product category of Life & Amenity related and Others |

| Faurecia | Dec. 2014 | Total sales | Total sales |

| Johnson Controls | Sep. 2014 | Sales of Automotive Experience division and Power Solutions division (26% for the OEM market) | Sales of Automotive Experience division and Power Solutions division (25% for the OEM market) |

| ZF Friedrichshafen | Dec. 2014 | 88% of the total sales (sectors for Car and light commercial vehicles and Commercial vehicles) | 88% of the total sales (sectors for Car and light commercial vehicles and Commercial vehicles) |

| Lear Corporation | Dec. 2014 | Total sales | Total sales |

| TRW Automotive | Dec. 2014 | Total sales | Total sales |

| Delphi Automotive | Dec. 2014 | Total sales | Total sales |

| Valeo | Dec. 2014 | Excluding Other segment | Total sales |

| Sumitomo Electric Industries | Mar. 2015 | Sales of Automotive Business segment | Sales of Automotive Business segment |

| Yazaki | Jun. 2014 | 86% of total sales (automotive related parts, estimate) | 86% of total sales (automotive related parts, estimate) |

| ThyssenKrupp | Sep. 2014 | 24% of the total sales (Automotive customer group) | 23% of the total sales (Automotive customer group) |

| Schaeffler | Dec. 2014 | Sales of Automotive Division | Sales of Automotive Division |

| HUAYU Automotive Systems | Dec. 2014 | Total of the sales by Product Line | Total of the sales by Product Line |

| Panasonic (Automotive & Industrial Systems Company) |

Mar. 2015 | 45% of the total sales (Automotive Systems) | 43% of the total sales (Automotive Systems) |

| Toyota Boshoku | Mar. 2015 | 95% of total sales (to the automotive industry) | 95% of total sales (to the automotive industry) |

| Mahle | Dec. 2014 | Total sales excluding Industry business unit and Profit centers and services | Total sales excluding Industry business unit and Profit centers and services |

| JTEKT | Mar. 2015 | Sales of Mechanical Components division | Sales of Mechanical Components division |

| Toyota Industries | Mar. 2015 | Sales of Automobile segment | Sales of Automobile segment |

| Autoliv | Dec. 2014 | Total sales | Total sales |

| Calsonic Kansei | Mar. 2015 | Total sales | Total sales |

| Magneti Marelli | Dec. 2014 | Total sales | Total sales |

| Tenneco | Dec. 2014 | Total sales | Total sales |

| Gestamp Automocion | Dec. 2014 | Total sales | Total sales |

| Weichai Power Co., Ltd. | Dec. 2014 | Sales of Finished vehicles and main auto parts segment and Other automotive components segment | Sales of Finished vehicles and main auto parts segment and Other automotive components segment |

| Benteler International | Dec. 2014 | Sales of Automotive Division | Sales of Automotive Division |

Foreign exchange rate

| Fiscal year end | Currency | Exchange rate * | Period | Fiscal year end | Currency | Exchange rate * | Period | Source |

|---|---|---|---|---|---|---|---|---|

| Dec. 2014 | USD/EUR | 1.3294 | Jan. 2014 - Dec. 2014 | Dec. 2013 | USD/EUR | 1.3279 | Jan. 2013 - Dec. 2013 | Bank of Japan |

| Sep. 2014 | USD/EUR | 1.3572 | Oct. 2013 - Sep. 2014 | Sep. 2013 | USD/EUR | 1.3115 | Oct. 2012 - Sep. 2013 | Bank of Japan |

| Mar. 2015 | JPY/USD | 109.76 | Apr. 2014 - Mar. 2015 |

Mar. 2014 | JPY/USD | 100.17 | Apr. 2013 - Mar. 2014 |

Mitsubishi UFJ Research and Consulting Co., Ltd. |

| Jun. 2014 | JPY/USD | 101.02 | Jul. 2013 - Jun. 2014 | Jun. 2013 | JPY/USD | 87.62 | Jul. 2012 - Jun. 2013 | Mitsubishi UFJ Research and Consulting Co., Ltd. |

| Dec. 2014 | KRW/USD | 1,051.91 | Jan. 2014 - Dec. 2014 | Dec. 2013 | KRW/USD | 1,093.78 | Jan. 2013 - Dec. 2013 | Mitsubishi UFJ Research and Consulting Co., Ltd. |

| Dec. 2014 | CNY/USD | 6.1428 | Jan. 2014 - Dec. 2014 | Dec. 2013 | CNY/USD | 6.1928 | Jan. 2013 - Dec. 2013 | State Administration of Foreign Exchange |

*Average exchange rate for fiscal year

Automotive Industry Portal

MarkLines Automotive Industry Portal is a one-stop B2B online information service for the automotive industry. The portal provides two kinds of services: research tools and marketing tools.

Research Tools:

MarkLines provides information about the global automotive market, which is useful to all companies working in the industry. This allows companies to save time and money by using MarkLines instead of conducting independent research.

Marketing Tools:

MarkLines has tools which promote a customer’s products, technologies and services to over 90,000 MarkLines’ members. MarkLines’ members include various OEMs and parts suppliers around the world.

By providing services with these research tools and marketing tools, MarkLines supports its customers’ procurement and marketing activities.

For press inquiries:

Amikawa, Kajiwara, Yukishima

Research Department, MarkLines Co., Ltd.

Tel:+81-3-5785-1385

e-mail:research-dept@marklines.com